Does an entity named the Depository Trust and Clearing Company own "all stocks" in the stock market? No, that's not true: It owns a subsidiary, the Depository Trust Company, whose function is to be a depository for securities. This subsidiary records other people's and companies' ownership. Neither the DTCC nor the DTC eliminates ownership rights of legitimate shareholders.

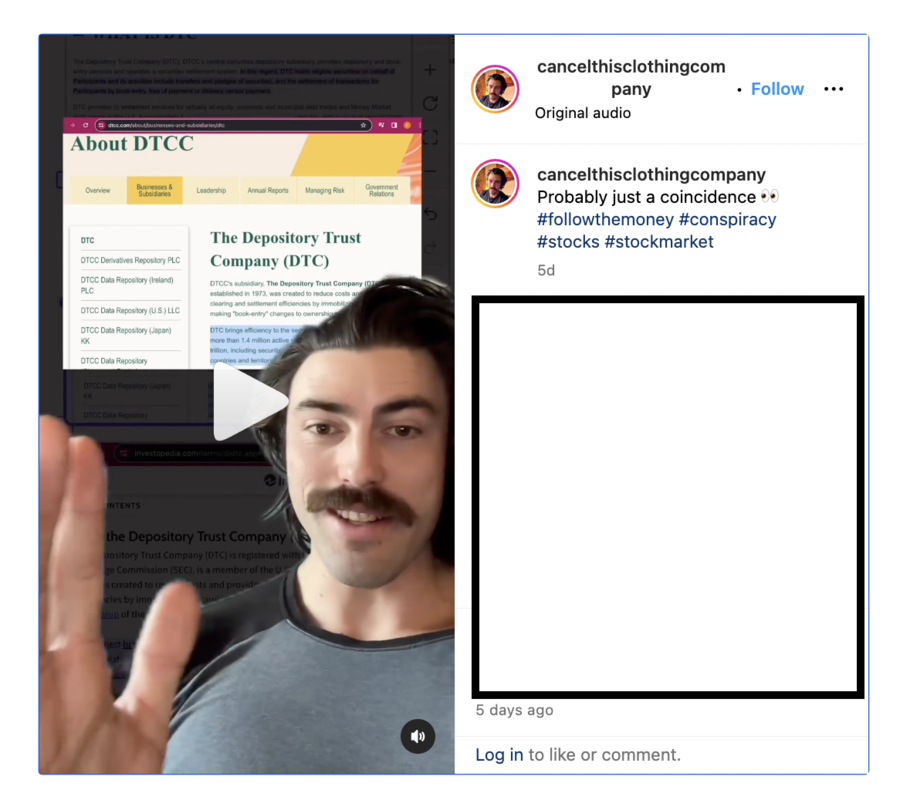

The claim originated from a post (archived here) on Instagram on January 3, 2024. It opened:

Probably just a coincidence 👀

#followthemoney #conspiracy #stocks #stockmarket

As a banner referring to the DTCC and the DTC appears in the background, a man in a video says:

... I recently talked about how the DTC owns every stock in the entire stock market. Most people don't know that you don't actually own stocks -- you own beneficial ownership of stocks. It's a whole rabbit hole, but all stocks are held by this private company. That's the holder that then like loans them out to people that loan them out to you, but they retain the legal ownership of all $87 trillion worth of U.S. stocks. And it's not a huge deal because the markets run how they run just fine when everything's normal. It only really becomes relevant when things start to collapse or explode or go wrong or weird, sketchy things happen. And then whoopsies, you don't actually have legal rights over this share.

This is what it looked like at the time of writing:

(Source: Instagram screenshot taken on Jan 9 17:51:35 2024 UTC)

owns the DTC and manages risk in the financial system. Formerly an independent entity, the DTC was consolidated with several other securities-clearing companies in 1999 and became a subsidiary of the DTCC.

This entity doesn't "own" stocks -- it maintains records of stocks' ownership through book entries, a system that replaced physical exchanges of certificates in the second half of the 20th century.

The claim does not reflect the reality, Columbia University Professor of Business Journalism Winnie O'Kelley (archived here) told Lead Stories in a January 9, 2024, email:

... it would be incorrect to say the DTCC 'owns' all the stocks in the market. It clears all the transactions and handles settlement. It does not own securities outright. Think of it as the plumbing of the market, as securities move from person to person and broker to investor. A unit, the DTC or Depository Trust Company, holds shares for others, like brokers and investors. ... the term 'own' would be incorrect.

Clearing is a post-trade process of managing and settling a transaction that takes some time after the move on the market.

A 2021 Bloomberg article (archived here) explains the role of clearinghouses such as the DTCC:

They exist to protect investors and the markets by making sure that participants like brokerage firms have the funds available to back up trades they make, and to determine who gets paid in the event of a default. ...

Because the settlement of a share trade happens two days after the transaction takes place, there's a risk the broker won't have the money to pay for shares its clients bought by the time of settlement.

It continues:

If the broker doesn't have enough funds to pay for the stock at the original higher price because it allowed clients to borrow half the amount, then the clearinghouse would be left on the hook. In case the collateral is still not enough and the broker in question is no longer around to be called upon for more, clearinghouses have a risk-sharing arrangement with their member firms who then provide the needed cash.

The website of the U.S. Securities and Exchange Commission (archived here) says that people can hold shares "directly with the company" or indirectly, "through a bank or broker-dealer" when they become beneficiary owners. That is the most common scenario in the United States.

However, beneficiary ownership does not prevent (archived here) a person from enjoying the benefits of such ownership, even when it comes to voting shares (archived here.)

Other Lead Stories fact checks on business-related topics can be found here.