Did the White House announce a new debt-relief program for veterans who owe money on their credit cards? No, that's not true: A video on Facebook that made this claim used a fake screenshot of the White House website to create a misleading impression involving an article supposedly published on July 6, 2024. In reality, the Biden-Harris White House made no such announcement. The federal Department of Veterans Affairs told Lead Stories that the ad had nothing to do with their agency, either.

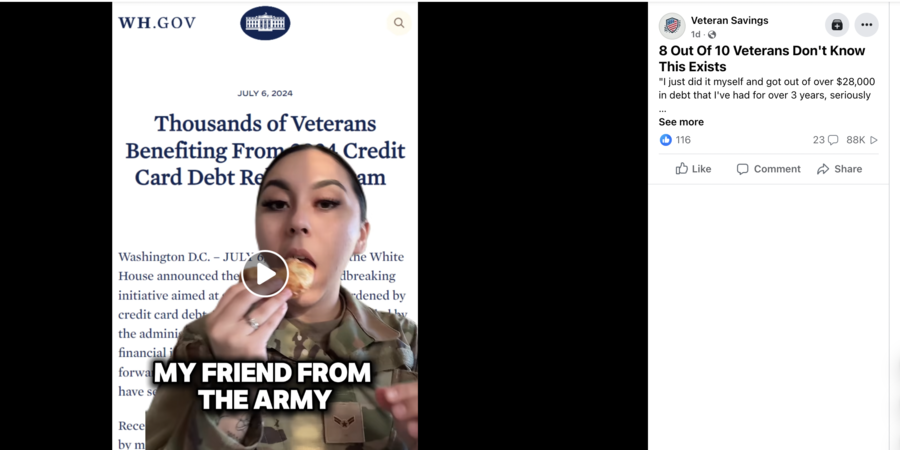

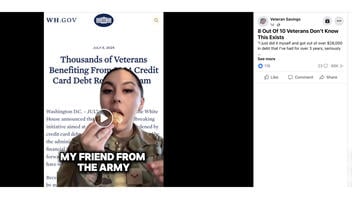

The video (archived here) appeared on Facebook on September 18, 2024, under the title:

8 Out Of 10 Veterans Don't Know This Exists

A female voiceover in the video continued:

My friend from the army laughed in my face when I told her veterans can get out of all their credit card debt, but when I showed her how it works, she was instantly jealous. If you're a veteran and owe $10,000 or more on your cards, but can't pay it off, there's a new program in 2024 that veterans are using to get out of thousands in debt. And the best part is you don't have to file for bankruptcy or take out a high interest loan. Here's all you need to do, jump over to this website. I'll leave the link below this post. Enter how much you owe and answer a few quick questions. Then you can see right there how much relief you qualify for. It only takes a couple seconds to check, and it doesn't cost anything to do this. I just tried it myself and got out of over $11,000 in debt that I've had for over three years. So if you're a veteran like me, do this right now before it's too late.

This is what the post looked like on Facebook at the time of writing:

(Source: Facebook screenshot taken on Fri Sep 20 14:40:51 2024 UTC)

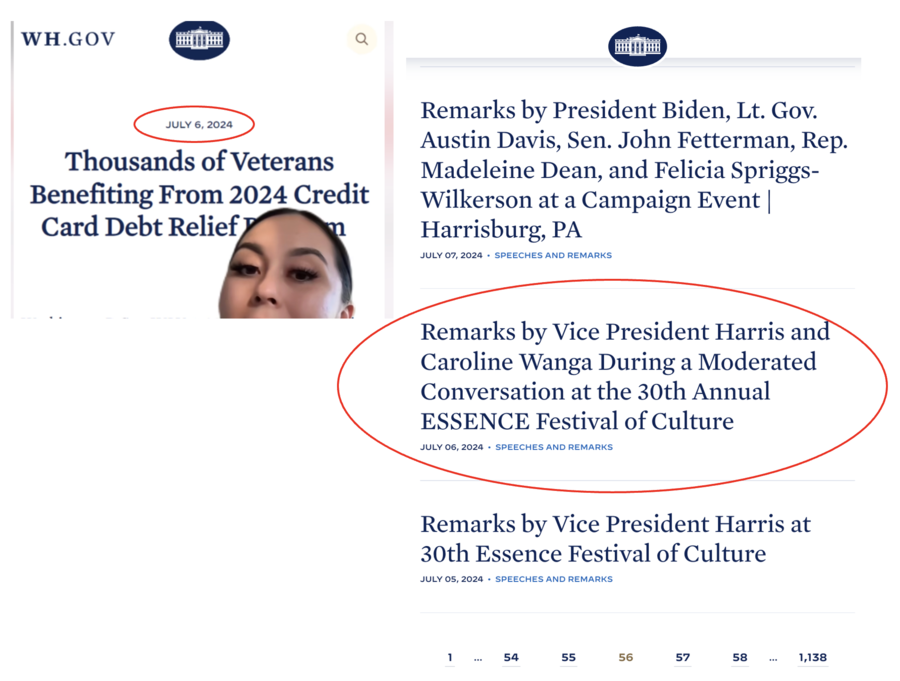

The video opened with what seemed to be a screenshot of a July 6, 2024, announcement on the White House website. The image implied that the supposed debt-relief program for videos is a new initiative of the Biden-Harris administration in the middle of the 2024 presidential campaign.

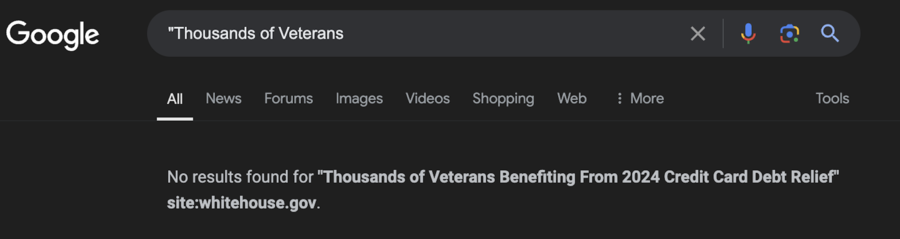

However, a Google search of the White House website for the exact wording from the purported official announcement produced no results. The search can be seen here (archived here) and below:

(Source: Google screenshot taken on Fri Sep 20 15:26:38 2024 UTC)

On July 6, 2024, the White House issued a single announcement (archived here), which had nothing to do with a "credit card debt relief program." What was published on that day was a transcript of Vice President Kamala Harris' remarks (archived here). Among many things, she discussed an initiative to stop reporting medical debt to credit bureaus, but she said nothing about credit cards.

(Sources: Facebook screenshot taken on Fri Sep 20 14:46:57 2024 UTC; White House screenshot taken on Fri Sep 10 15:01:09 2024 UTC; composite image by Lead Stories)

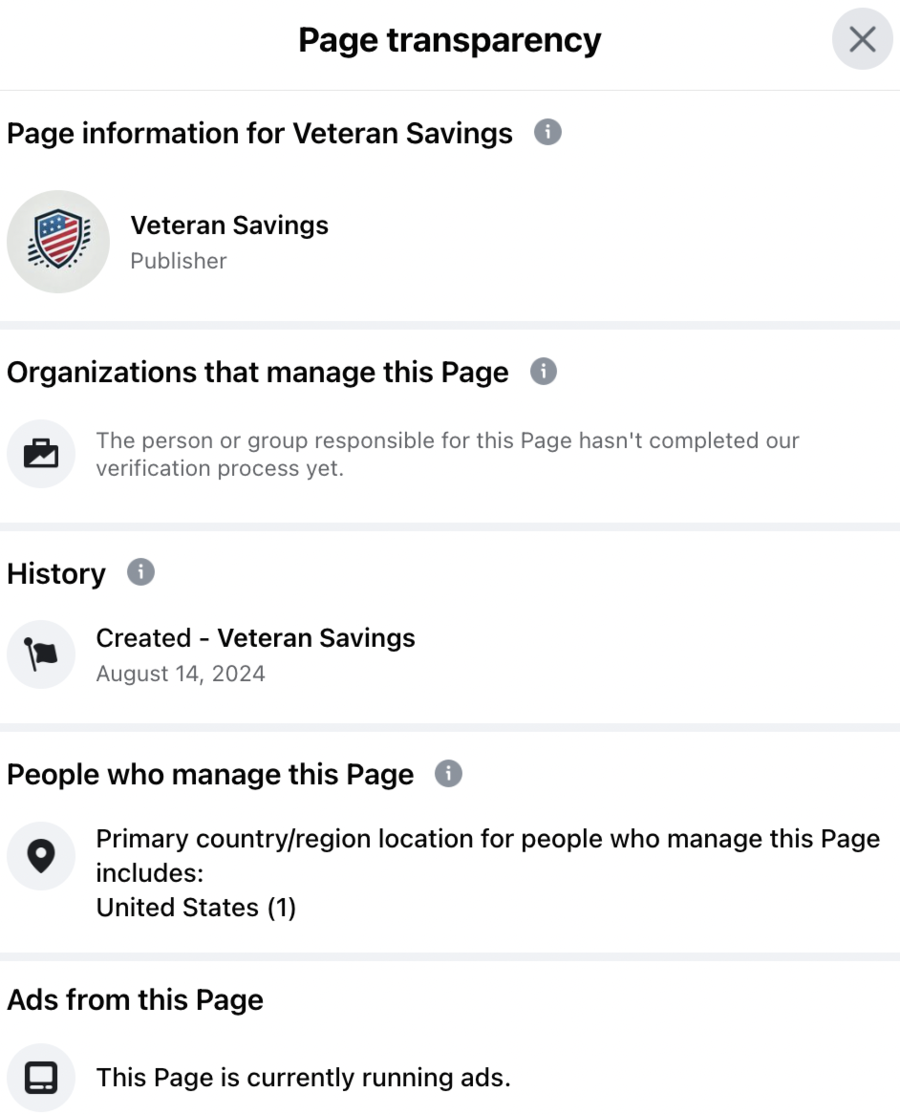

The page on Facebook that published the video had been created just a little bit over a month before running the ad campaign of which this video was part (archived here). As the Page transparency tab showed, the account was not affiliated with the federal government:

(Source: Facebook screenshot taken on Fri Sep 20 16:37:27 2024 UTC)

A spokesperson for the federal Department of Veterans Affairs (VA) told Lead Stories via email on September 20, 2024:

These are commercial companies that advertise on social media and across the internet and are not affiliated with VA.

The video contained what appeared to be a screenshot of an email with a sender's address linked to a company named "Finance Help USA":

(Source: Facebook screenshot taken on Fri Sep 20 14:46:45 2024 UTC)

Unlike normal emails of government employees, the one seen in the video did not end with .gov.

".Org" is an ending frequently used by reputable professional associations or nonprofits. However, that was not the case here.

A search for the official website of this supposed organization led to another page on Facebook (archived here), with only one post from September 2022. The page's About section (archived here) linked to a website, https://financehelpusa.org/ (archived here) that redirected to a different website (https://ww12.financehelpusa.org/) with a green banner on its home page that said, "This domain name may be for sale."

From the site's home page, a user could reach a page offering help with dealing with debt collectors:

(Source: Finance Help USA screenshots taken on Fri Sep 20 between 15:32:11 and 15:34:24 2024 UTC)

A search for the name of the email recipient seen in the video on Facebook -- "Savannah Sanchez" -- led to articles about an ad creator, not a veteran (archived here). In one of the videos, that person was seen saying that ads using voiceovers perform better.

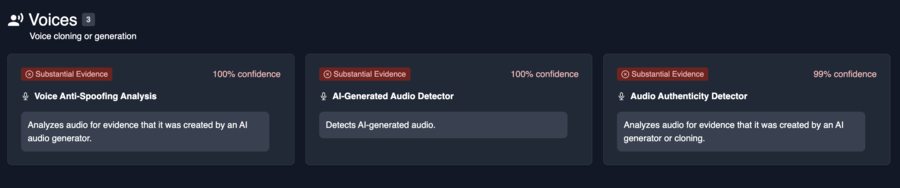

According to the AI-detection tool True Media (archived here), the video that is the focus of this fact check contained an AI-generated voice:

(Source: True Media screenshot taken on Fri Sep 20 16:30:25 2024 UTC)

The website of the Federal Trade Commission (FTC) shows a list of many cases (archived here) in which scammers pretended to offer some debt relief on behalf of the federal government.

The FTC (archived here) warns:

Debt relief service scams target consumers with significant credit card debt by falsely promising to negotiate with their creditors to settle or otherwise reduce consumers' repayment obligations. These operations often charge cash-strapped consumers a large up-front fee, but then fail to help them settle or lower their debts - if they provide any service at all ...

The FTC has brought scores of law enforcement actions against these bogus credit-related services, and the agency has partnered with the states to bring hundreds of additional lawsuits. Further, in 2010, the FTC amended its Telemarketing Sales Rule to protect consumers seeking debt relief services, like debt settlement or credit counseling. The Rule prohibits for-profit companies that sell these services over the telephone from charging a fee before they actually settle or reduce a consumer's debt. It also prohibits debt relief providers from making misrepresentations and requires that they disclose key information that consumers need in evaluating these services.

In October 2023, the same company, Finance Help USA, was advertised in another misleading video, as reported by PolitiFact.

Other Lead Stories fact checks about credit-card debt are here. Fact checks mentioning the White House can be found here. Fact checks about the 2024 U.S. presidential election campaign are here.