Is the Biden administration implementing a per-mile "driving tax" that would charge U.S. drivers an estimated eight cents per mile? No, that's not true: The Infrastructure Investment and Jobs Act, which has not passed at the time of writing, only details a pilot program for a vehicle-miles traveled fee (VMT fee). Additional legislation would have to be passed to implement this.

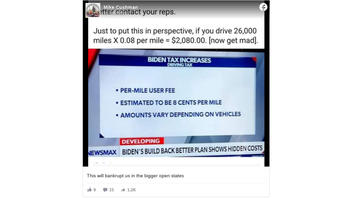

The claim appeared in a Facebook post (archived here) on September 28, 2021. The post included a picture of a Newsmax report, showing information about what they call a "driving tax" with a per-mile user fee that is estimated to be eight cents per mile with varying amounts depending on the vehicle. The text above the picture of the report said:

Better contact your reps.

Just to put this in perspective, if you drive 26,000 miles x 0.08 per mile = $2,080.00. [now get mad].

This is what the post looked like on Facebook on September 29, 2021:

(Source: Facebook screenshot taken on Wed Sep 29 21:58:49 2021 UTC)

According to Congress.gov, the online database of congressional legislative documents, the Infrastructure Investment and Jobs Act, known as HR 3684, is in the process of reconciliation, or differences being resolved, and has not become law at the time of writing. A screenshot about the act from the website is included below:

(Source: Congress.gov screenshot taken on Wed Sep 29 19:24:49 2021 UTC)

The details of the act were agreed upon (archived here) by the Biden administration and a bipartisan group on July 28, 2021. In an email to Lead Stories on September 29, 2021, the press office of the U.S. Department of Transportation said of the claim:

No, this is not accurate. There is not a VMT tax in the bill. The President has made clear he does not support raising taxes on Americans making less than $400,000 a year. As you mention, there is a pilot program just like there have been in previous reauthorization bills.

Information about the "National Motor Vehicle Per-Mile User Fee Pilot" can be found in section 13002 starting on page 508 of the act (archived here). The act describes the program as "a pilot program to demonstrate a national motor vehicle per-mile user fee":

(A) to restore and maintain the long-term solvency of the Highway Trust Fund; and

(B) to improve and maintain the surface transportation system.

The objective of the pilot program is as follows:

(A) to test the design, acceptance, implementation, and financial sustainability of a national motor vehicle per-mile user fee;

(B) to address the need for additional revenue for surface transportation infrastructure and a national motor vehicle per-mile user fee; and

(C) to provide recommendations relating to the adoption and implementation of a national motor vehicle per-mile user fee.

Only volunteer participants would be charged in the pilot program and they would be reimbursed (see page 518 at "PAYMENT").

In a phone call with Lead Stories on September 29, 2021, Andy Winkler, director of the Bipartisan Policy Center's infrastructure project, clarified:

[The act] calls for a national pilot of a vehicles-mile [sic] travel tax. So instead of the gas tax, you would pay some sort of fee based on the mileage that your car uses. The idea being that over time, particularly as we move to electric vehicles, people will pay less and less in the gas tax, so we need to find an alternative source of revenue to pay for the Highway Trust Fund, the federal government's primary means of paying for surface transportation programs.

As Winkler stated, the motor fuel excise tax is the largest source of revenue used to support the Highway Trust Fund. However, it may become obsolete as more drivers opt for all-electric vehicles, known as EVs. Therefore, the idea of VMT fee programs is gaining more traction. VMT fee programs have already been operating on the state level in Oregon and Utah but there has not yet been a VMT fee implemented on the national level.

Winkler said that such a national program is unlikely to happen soon. The Infrastructure Investment and Jobs Act still would need to become law and the pilot program would take years to prepare and execute. Hypothetically, an actual VMT fee program could only be applied to all U.S. drivers if additional legislation is passed further down the line.

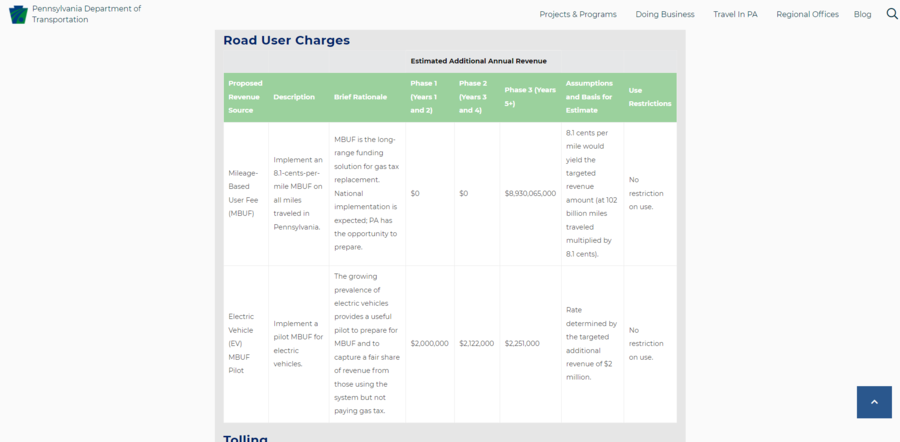

Lead Stories could not locate the "eight cents per mile" VMT fee claim within the Infrastructure Investment and Jobs Act; however, the figure is reminiscent of a suggestion by Pennsylvania's Transportation Revenue Options Commission. In a report submitted to the state's governor on July 30, 2021, the commission proposed a mileage-based user fee set at 8.1 cents per mile traveled in the state. A screenshot from the report with more information about Pennsylvania's proposed mileage-based user fee is included below:

(Source: Pennsylvania Department of Transportation screenshot taken on Wed Sep 29 21:18:59 2021 UTC)