STORY UPDATED: check for updates below.

Does the 2021 infrastructure bill include a $6,500 tax on dairy cows, $2,600 per head tax on beef cows and $500 per head tax on swine? No, that's not true: There is no such language in the infrastructure legislation, according to the publicly available text.

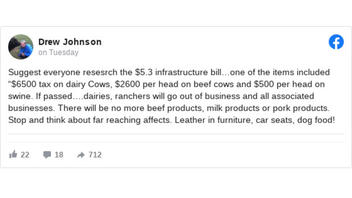

The claim appeared in a Facebook post (archived here) on September 28, 2021. It opens:

Suggest everyone resesrch the $5.3 infrastructure bill...one of the items included "$6500 tax on dairy Cows, $2600 per head on beef cows and $500 per head on swine. If passed....dairies, ranchers will go out of business and all associated businesses. There will be no more beef products, milk products or pork products. Stop and think about far reaching affects. Leather in furniture, car seats, dog food!

This is what the post looked like on Facebook at the time of writing:

(Source: Facebook screenshot taken on Thu Sep 30 23:03:19 2021 UTC)

The 2021 "Build Back Better Act" for infrastructure improvement does not include agriculture as part of the methane emissions fee in its language. It only covers oil and gas sources.

"There is absolutely no provision in the Build Back Better Act that would impose the fees you've described," a spokesperson for the House Energy & Commerce Committee told Lead Stories via email on September 30, 2021. "The methane fee only applies to certain oil and gas facilities. And as you can see, the text is very clear about the fact it only covers oil and gas sources, it cannot be interpreted as leaving any doors open for EPA to expand the fee to agriculture sources." Livestock produce methane by digesting certain kinds of feed and fermenting manure also releases methane.

Lead Stories searched the legislation for the words "dairy," "cow," "swine," "cattle" and "agriculture," and found no matches in the text.

The source of the numbers appears to have been the American Farm Bureau which gave them to Oklahoma Republican Rep. Markwayne Mullin, the Tulsa World reported. The news outlet noted Rep. Mullin's "now widely-shared commentary" titled, "Blank Check for Socialism," used the numbers:

In an attempt to eliminate fossil fuels, this legislation would impose a "fee" on all methane emissions, including in our agriculture industry. We all know that a fee is just a tax and that consumers are the ones who will pay for it. The tax is estimated to cost $6,500 per dairy cow, $2,600 per head of cattle, and $500 per swine each year. That is more than what the animals are worth, it'll run ranchers out of business.

The Tulsa World reported Mullin's spokesperson confirmed the "per-cow estimates Mullin shared in his commentary also came from an analysis by the American Farm Bureau," which is an insurance company and lobbying organization that does not produce independent analysis.

But the American Farm Bureau Federation says its analysis should not be interpreted to mean the per-head tax on livestock is part of the bill.

On its website, Farm Bureau Federation Vice President for Public Affairs Sam Kieffer wrote:

To clear up any confusion, I want to make clear that the current language of the reconciliation bill does not impose a methane tax on agriculture...Over the summer, American Farm Bureau economists conducted an analysis, at the request of Congressional committee staff, to determine the potential impact if agriculture were to be included in legislation imposing such a tax.

Lead Stories reached out to Rep. Mullin for comment and will update when a response is received.

Updates:

-

2021-10-01T00:50:34Z 2021-10-01T00:50:34Z Updated to include American Farm Bureau Federation statement about its analysis.