Do undocumented immigrants in the United States not pay taxes? No, that's not true: The claim made by Elon Musk on X that "illegals in America" do not pay taxes is "absolutely false," the deputy director of the Institute on Taxation and Economic Policy, a nonpartisan think tank, told Lead Stories. "Undocumented immigrants pay a range of taxes at every level of government," he said. An economist with George Mason University told Lead Stories that Musk was "completely wrong" about his claims regarding undocumented immigrants not paying taxes in the United States. A Social Security Administration report from 2010, the latest year available, estimated that unauthorized workers paid about $12 billion in taxes.

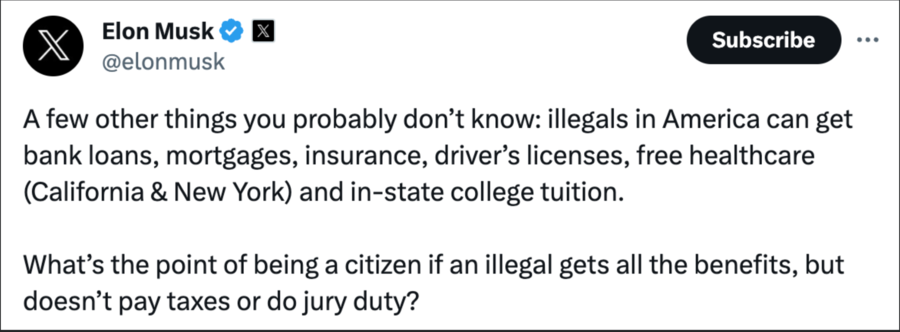

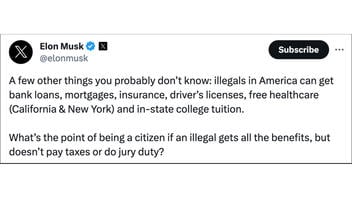

The claim appeared in a post published on X, formerly known as Twitter, by Musk, its owner, on February 3, 2024 (archived here). Musk's post opened:

A few other things you probably don't know: illegals in America can get bank loans, mortgages, insurance, driver's licenses, free healthcare (California & New York) and in-state college tuition. What's the point of being a citizen if an illegal gets all the benefits, but doesn't pay taxes or do jury duty?

This is what the post looked like on X at the time of writing:

(Source: X screenshot taken on Fri Feb 9 17:59:01 2024 UTC)

This fact check will focus only on the claim that an undocumented immigrant, called an "illegal" in Musk's post, "doesn't pay taxes."

Jon Whiten (archived here), deputy director at the Institute on Taxation and Economic Policy (archived here), a think tank in Washington, D.C., told Lead Stories via email on February 7, 2024, that Musk's claim is incorrect:

This claim is absolutely false. Undocumented immigrants pay a range of taxes at every level of government.

At the state and local levels, most taxes are collected regardless of citizenship status. Best Buy doesn't ask for your papers if you're buying a new TV. Undocumented immigrants, like everyone else, pay sales and excise taxes when they buy things, they pay property taxes either directly (as homeowners) or indirectly (as renters), and many pay state income taxes as well.

And at the federal level, many undocumented immigrants pay federal payroll and income taxes, as well as excise taxes on things like fuel.

Economist Michael Clemens (archived here), a senior fellow at the Center for Global Development and an economics professor at George Mason University, told Lead Stories via email on February 7, 2024, that Musk was "completely wrong" about his claim that "illegals in America" do not pay taxes:

Elon Musk is completely wrong about this. The world's richest person could found ten different universities to do nothing but study this specific issue if he really wanted to know more about it. Instead he chooses to disseminate falsehoods to millions. How sad and irresponsible.

Clemens explained how undocumented immigrants pay taxes in the United States:

Yes of course, foreign-born people pay numerous taxes in the United States regardless of their immigration status. Specifically, unauthorized immigrants pay excise taxes like sales tax, a major source of local revenue. They very often pay payroll taxes like the taxes that support social security and medicare, because employers withhold money from workers' salaries to pay those taxes regardless of the employee's immigration status.

They pay property taxes, either directly as homeowners or, more commonly, indirectly as additional rent that landlords charge renters in order to cover the property taxes on an apartment building. Beyond those, by adding to employers' bottom line (which is why employers employ them), unauthorized migrants cause additional tax revenue via taxes on capital income.

Lead Stories contacted the Internal Revenue Service for a response to the claim. We will update this fact check as soon as it is received.

A spokesperson for the Social Security Administration (SSA) responded to Lead Stories via email on February 8, 2024, and directed us to a 2013 report ("Effects of Unauthorized Immigration on the Actuarial Status of the Social Security Trust Fund") on the SSA website. It estimated that "unauthorized workers" had paid billions of dollars in taxes in 2010. That is the most recent year for which data was available.

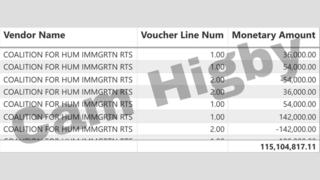

The estimate can be seen on page two of the report (archived here):

For the year 2010, we estimate that the excess of tax revenue paid to the Trust Funds over benefits paid from these funds based on earnings of unauthorized workers is about $12 billion.

The Trust Funds are a program of monthly payments to retirees, survivors and the disabled (OASDI), according to the SSA.

Page three of the report continued:

While unauthorized immigrants worked and contributed as much as $13 billion in payroll taxes to the OASDI program in 2010, only about $1 billion in benefit payments during 2010 are attributable to unauthorized work. Thus, we estimate that earnings by unauthorized immigrants result in a net positive effect on Social Security financial status generally, and that this effect contributed roughly $12 billion to the cash flow of the program for 2010. We estimate that future years will experience a continuation of this positive impact on the trust funds.

The National Immigration Law Center states on their website (archived here) that undocumented immigrants to pay taxes:

Despite any misconceptions to the contrary, immigrants pay taxes just as everyone else does--and this includes immigrants without authorization to be in the U.S. Why? They are required to do so by law. Also, immigrants want to file their taxes because they see it as an opportunity to contribute, to prove their economic contribution to the U.S., and to document their residence here.

Additional Lead Stories fact checks of claims about illegal immigrants in the U.S. can be found here.