Does Joe Biden's capital gains tax mean that when you sell your home you'll owe taxes of 40% of your profit? No, in all but a smattering of situations, that's not true. Biden's plan does not propose eliminating the tax exclusion for capital gains on the sale of your main home.

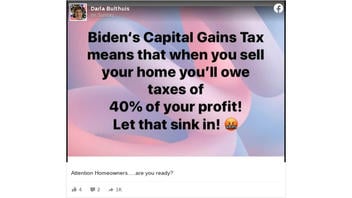

The claim appeared in a Facebook post (archived here) on October 11, 2020. It included a short message and a meme. The message asked: "Attention Homeowners.....are you ready?" The meme read:

Biden's capital gains tax means that when you sell your home you'll owe taxes of 40% of your profit! Let that sink in!

This is what the post looked like at the time of writing:

(Source: Facebook screenshot taken on Tue Oct 13 16:06:56 2020 UTC)

Currently, the Internal Revenue Service allows qualified home sellers to exclude up to $250,000 of a capital gain, or up to $500,000 if you file jointly with a spouse.

Let's say, for example, that you're single and bought a house for $250,000. Six years later, you sold it for $350,000, marking a capital gain of $100,000. As that's less than the exclusion amount, you'd likely owe no taxes on the gain, assuming you meet both the ownership and use test, as well as other criteria.

That's true now -- and it would be under a Biden administration. His campaign has not proposed eliminating the exclusion.

There are situations, however, where someone might be subject to a capital gains tax related to the sale of a home: if you're selling a house that's not your primary residence, for example, or if you have a capital gain that exceeds the exclusion amount. In those situations, you'd owe taxes.

Still, the rate would not rise, compared to today, unless you're a top earner. Biden's campaign has proposed raising the capital gains rate -- to 39.6% -- for taxpayers with incomes above $1 million. If you earn less than that, there would be no increase in the tax rate on capital gains. And, again, you're not likely to owe anything, so long as the home you're selling is your main home and your gain is not more than $250,000 (or $500,000 for joint returns).