Are a series of U.S. financial laws rattled off in a social media video the "six infinity stones" to "snap away your problems"? No, that's not true: The laws mentioned in the 54-second video define aspects of America's financial system and how it operates but the man listing them provides no context and fails to explain how any of the laws could alleviate our difficulties instantly.

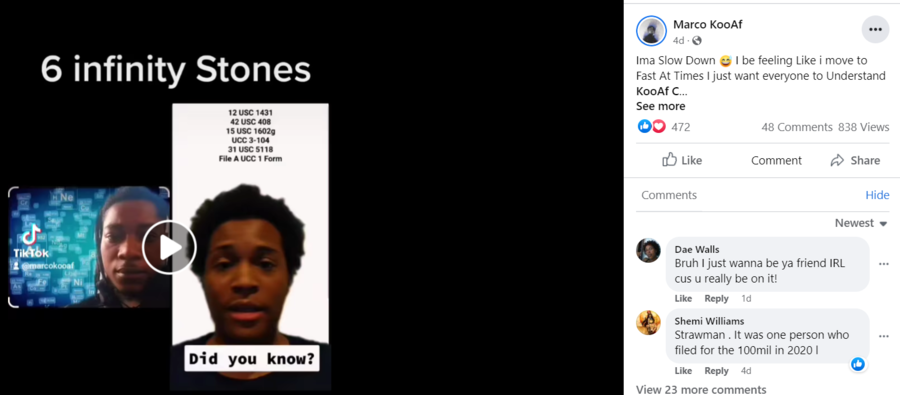

The claims appeared in a Facebook post (archived here) on March 24, 2022, titled "6 infinity Stones ... Did you know?" It opened:

Ima Slow Down 😅 I be feeling Like i move to Fast At Times I just want everyone to Understand KooAf Collabs ima let fb breathe💡🪄 peace god

This is what the post looked like on Facebook on March 29, 2022:

(Source: Facebook screenshot taken on Tue Mar 29 15:46:32 2022 UTC)

The narrator of the video reels off the six laws in less than a minute with little explanation -- comparing them to the six infinity stones of Avengers fame and promising they will "snap away your problems." Here's what he says:

Did you know that per 12 USC 1431, banks can't actually loan you any money because they're the borrowers?

Did you know that per 42 USC 408, asking for your Social Security number on any credit transaction or loans, because there is no lawful money, is a crime?

Did you know that per 15 USC 1602(g), that we, the consumers, are the creditors?

Did you know that UCC 3-104 explains what a negotiable instrument is and how to use it?

Did you know that per 31 USC 5118 that you can discharge all debts and it doesn't even have to be in legal tender any more?

And, did you know that after you file a UCC-1 form and set up a foreign trust account after you've authenticated your birth certificate, you have full access to House Joint Resolution-192 and Public Law 73-10 for the discharge of debts?

Those are the six infinity stones for you to just snap away your problems.

Four of the laws listed in the video come from the U.S. Code or USC. This is how the U.S. Senate website describes it:

The United States Code is a compilation of most public laws currently in force, organized by subject matter. When a law has been amended by another law, the U.S. Code reflects this change. The U.S. Code collates the original law with subsequent amendments, and it deletes language that has later been repealed or superseded.

The other two "infinity stones" come from the Uniform Commercial Code (UCC), a "comprehensive set of laws governing all commercial transactions in the United States. It is not a federal law, but a uniformly adopted state law."

Much of the advice flies in the face of common sense. Let's take it stone by stone.

1. Banks can't loan you money because they're the borrowers

This ignores the fact that millions and millions of Americans have taken out loans at banks. Banks do borrow money from the Federal Reserve but are required to hold a certain amount of deposits to back those loans. In particular, 12 U.S. Code § 1431 specifically deals with the Federal Home Loan Bank and the "powers and duties of banks."

2. Asking for your Social Security number on any credit transaction or loan is a crime

It's illegal to use someone's Social Security number to deceive the Internal Revenue Service. 42 U.S. Code § 408 falls under the penalties section of the Internal Revenue Code. This law has nothing to do with asking for a Social Security number on a credit transaction or loan and neither word appears in the language of the law.

3. We, the consumers, are the creditors

Apples ≠ oranges. 15 U.S. Code § 1602(g) defines both consumers and creditors. They are not the same thing.

4. UCC 3-104 explains what a negotiable instrument is and how to use it

A negotiable instrument is an "unconditional promise or order to pay a fixed amount of money, with or without interest." It could be in the form of a check or a certificate of deposit.

5. You can discharge all debts and it doesn't have to be in legal tender any more

The U.S. still requires legal tender (money). This law -- 31 U.S. Code § 5118 -- goes back to 1933 when the United States went off the gold standard. Up until then, the U.S. monetary system was backed by gold. If you had a dollar bill you could trade it for a dollar's worth of gold. Going forward, the value of American currency, or legal tender, was no longer tied to the precious metal and the U.S. government was no longer liable to pay out its value in gold.

6. After you file a UCC-1 form and set up a foreign trust account after you've authenticated your birth certificate, you have full access to House Joint Resolution (HJR) -192 and Public Law 73-10 for the discharge of debts

A Uniform Commercial Code filing (UCC-1 form), setting up a foreign trust account and authenticating a birth certificate has nothing to with accessing HJR-19 and Public Law 73-10, which suspended the gold standard in the United States (covered above).

While all of these six "infinity stones" play an important role in the U.S. financial system, none of them have magical powers that can instantly change anyone's life and get rid of their problems.