Is a "WEF agent" revealing a plan to exclude "less desirable" people from digital currency that will take over the world? No, that's not true: The man in the first clip in the video is a renowned Cornell University professor who was speaking at a World Economic Forum event but he is not an "agent" of the organization. He was actually warning about the possible use of Central Bank Digital Currencies (CBDCs) by authoritarian regimes as a way of surveilling citizens.

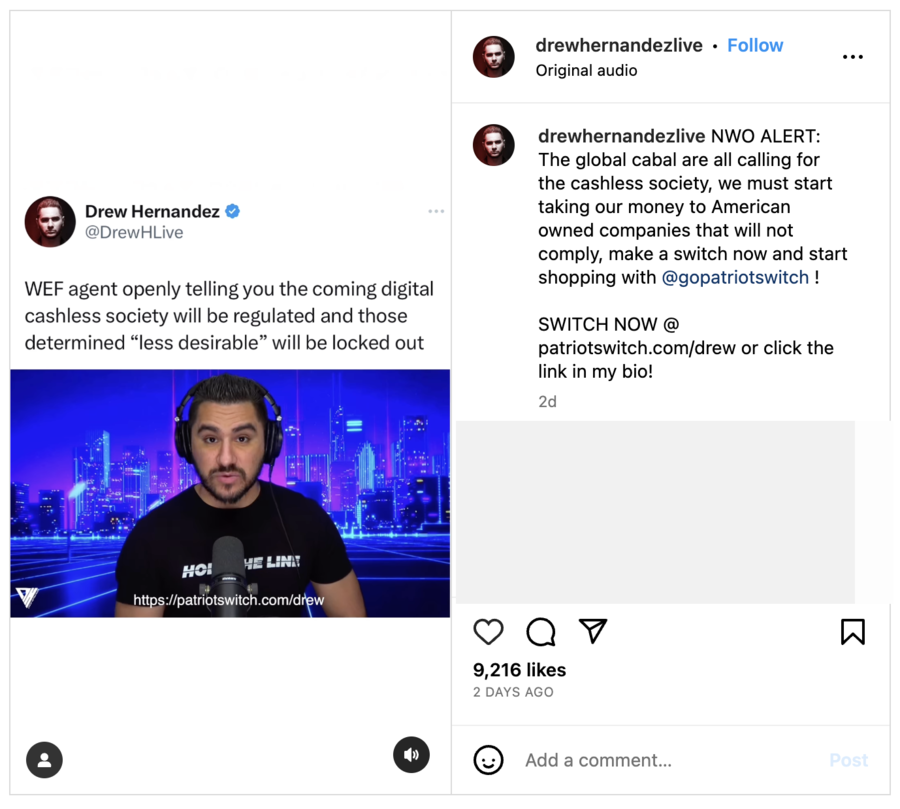

The claim appeared in a video on Instagram on July 9, 2023, with the caption, "WEF agent openly telling you the coming digital cashless society will be regulated and those determined 'less desirable' will be locked out." It opened with a person on the video saying:

The benefits of digital money there are huge potential gains.

This is what the post looked like on Instagram at the time of writing:

(Source: Instagram screenshot taken on Wed Jul 12 14:20:15 2023 UTC)

The caption on the post says:

NWO ALERT: The global cabal are all calling for the cashless society, we must start taking our money to American owned companies that will not comply, make a switch now and start shopping with @gopatriotswitch ! SWITCH NOW @ patriotswitch.com/drew or click the link in my bio!

The video begins with a clip of Eswar Prasad, the Tolani senior professor of trade policy at Cornell University, speaking at the WEF on the topic, "The Future of Money," which streamed on June 28, 2023. In the short clip on Instagram Prasad says:

The benefits of digital money that are huge potential gains. You could have, as I argue in my book, a potentially better and some people might say a darker world where the government decides that units of central bank money can be used to purchase some things but not other things that it deems less desirable.

This is an edited version of what Prasad actually said, which begins at 32:32 in the video posted on the WEF YouTube page:

If you think about the benefits of digital money there are huge potential gains. It is not just about digital forms of physical currency. You can have programmability. Units of central bank currency with expiring dates. You could have, as I argue in my book, a potentially better and some people might say a darker world where the government decides that units of central bank money can be used to purchase some things but not other things that it deems less desirable like say ammunition or drugs or pornography or something of the sort.

Continuing in the video, Prasad warned about digital money:

That is very powerful in terms of the use of a CBDC and, I think, also extremely dangerous for central banks. Because ultimately if you have different units of central bank money, with different characteristics, or if you use central bank money as a conduit for economic policies, in a very targeted way, or more broadly for social policies -- that could really affect the integrity of central bank money, and the integrity and independence of central banks. So there are wonderful notions of things that can be done with digital money, but again I fear that technology could take us to a better place, but equally has the potential to take us to a pretty dark place.

Prasad is on record as having warned about this possible feature of future CBDCs in the past. In this April 1, 2022, Washington Post column titled "Cryptocurrency could help governments and businesses spy on us," he wrote:

Digital 'smart money' that replaces cash could become an instrument of government control, with authoritarian regimes using it as a surveillance tool and even ostensibly benevolent governments conceivably employing it to promote social objectives: preventing its use to purchase ammunition, abortion services or pornography, for instance ...

Bitcoin's blockchain technology will help in creating better digital payment systems, automating a broad range of transactions and democratizing finance. But in an ironic twist, the true (and potentially dark) legacy of bitcoin might be the erosion of confidentiality, the broader prevalence of government-managed payment systems, and a greater intrusion of big business and government in financial systems -- and in the functioning of society.

Lead Stories has debunked other claims about the World Economic Forum here.