Does a viral social media post show an authentic memo confirming that then-IRS Commissioner Roscoe Egger instructed his subordinates in 1985 that "every tax paid into the Treasury since 1913, is due and refundable to every citizen and business"? No, that's not true: Both the IRS and the defense attorney whose case was cited in the memo agreed in the 1990s that the document was a forgery. A 2011 search of the IRS archives aimed at finding the original of the memo returned no results.

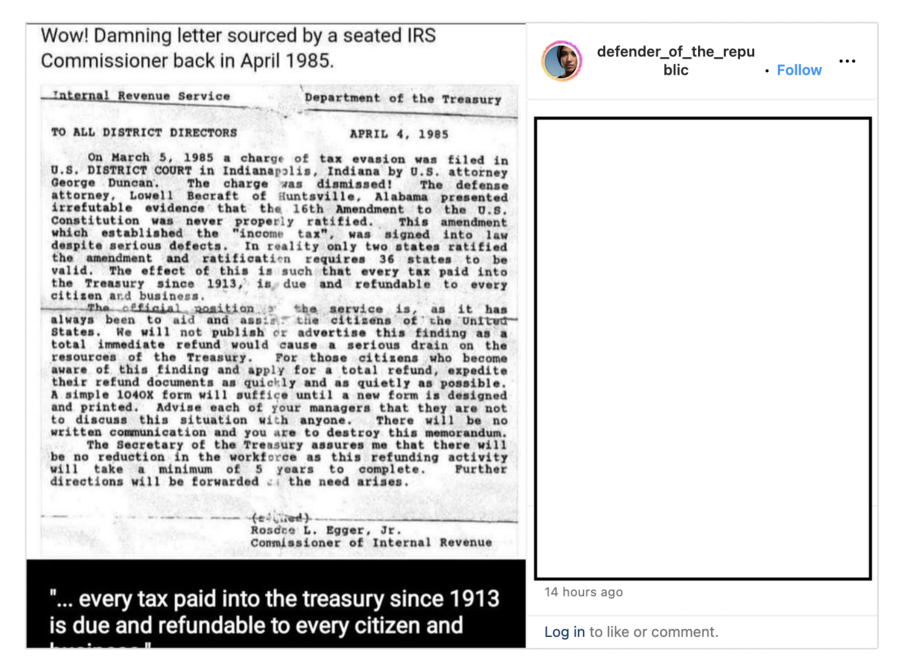

The claim reappeared in a post (archived here) on Instagram on February 12, 2024. The add-on text on top of the image began:

Wow! Damning letter sourced by a seated IRS Commissioner back in April 1985.

The shared file resembling a copy of an old government document said:

On March 5, 1985 a charge of tax evasion was filed in U.S. DISTRICT COURT in Indianapolis, Indiana by U.S. attorney George Duncan. The charge was dismissed! The defense attorney, Lowell Becraft of Huntsville, Alabama presented irrefutable evidence that the 16th Amendment to the U.S. Constitution was never properly ratified. This amendment which established the 'income tax', was signed into law despite serious defects. In reality only two states ratified the amendment and ratification requires 36 states to be valid. The effect of this is such that every tax paid into the Treasury since 1913, is due and refundable to every citizen and business.

The official position [of] the service is, as it has always been to aid and assist the citizens of the United States. We will not publish or advertise this finding as a total immediate refund would cause a serious drain on the resources of the Treasury. For those citizens who become aware of this finding and apply for a total refund, expedite their refund documents as quickly and as quietly as possible. A simple 1040X form will suffice until a new form is designed and printed. Advise each of your managers that they are not to discuss this situation with anyone. There will be no written communication and you are to destroy this memorandum. The Secretary of the Treasury assures me that there will be no reduction in the workforce as this refunding activity will take a minimum of 5 years to complete.

This "memo" has been circulating for decades, but its authenticity has never been confirmed.

Back in 1993, an IRS spokeswoman, Johneli Hunter, described it as a "forgery" in a newspaper article (archived here) published by The Daily Herald in Provo, Utah.

The newspaper went further and interviewed a man mentioned in the first paragraph of the "memo": an Alabama tax attorney, Becraft, whose first name turned out to be not Lowell but Larry. He, too, refuted the claim.

Becraft told The Daily Herald that he had seen the letter for the first time in 1985. But, while he indeed brought up the 16th Amendment issues to defend his client, the judge did not agree with him, and the client was convicted.

Becraft added that the "memo" didn't get right the name of another key party to the case: The prosecutor who filed the case was not George but Roger Duncan.

Almost two decades later, in 2011, a court filing (archived here) revealed that when the IRS searched for the original document in response to a Freedom of Information Act request, it found nothing. The court rejected the claim that the agency didn't act in good faith.

Contrary to the claim that is the focus of this fact check, Egger publicly argued against what he described as "quickie refunds" automatically generated by the agency. Under him, a new interim rule allowed the IRS to manually evaluate whether there was "a gross valuation overstatement, or a false ... [or] fraudulent statement with respect to the tax benefits." According to the 1985 Washington Post article (archived here) covering the story, one form this policy change applied to was the 1040X from the "memo."

The notion that federal income taxes are not mandatory is linked to the ideology of the sovereign citizen movement, whose members believe they can reject the laws of the United States. The Southern Poverty Law Center (archived here) describes the roots of this ideology as "racist and antisemitic." Back in the early 2010s, the FBI (archived here) described the movement as an extremist organization.

As of this writing the IRS website (archived here) ultimately rejects that anything related to the 16th Amendment grants any legitimacy to tax evasion or blanket nationwide refunds for what has been paid since 1913, when the federal income tax was introduced (archived here):

The Internal Revenue Code imposes a federal income tax upon all United States citizens and residents ... In United States v. Collins, 920 F.2d 619, 629 (10 th Cir. 1990), cert. denied, 500 U.S. 920 (1991), the court cited Brushaber v. Union Pac. R.R., 240 U.S. 1, 12-19 (1916), and noted the United States Supreme Court has recognized that the 'Sixteenth Amendment authorizes a direct nonapportioned tax upon United States citizens throughout the nation, not just in federal enclaves.'

Lead Stories previously fact checked another claim based, in part, on bogus Uniform Commercial Code filings, which is another tool associated with common tactics of the sovereign citizen movement.

Other Lead Stories fact checks about taxes can be found here.