Can incarcerated people receive the $1,200 economic stimulus check behind bars? Yes, that's true. Prison inmates were previously banned by the IRS from receiving a check from the federal government because they were in jail or prison. A September 24, 2020 ruling by the United States District Court for the Northern District of California ordered the IRS and the U.S. Department of Treasury to stop withholding benefits to anyone on the "sole basis of their incarcerated status," according to the court order filed online.

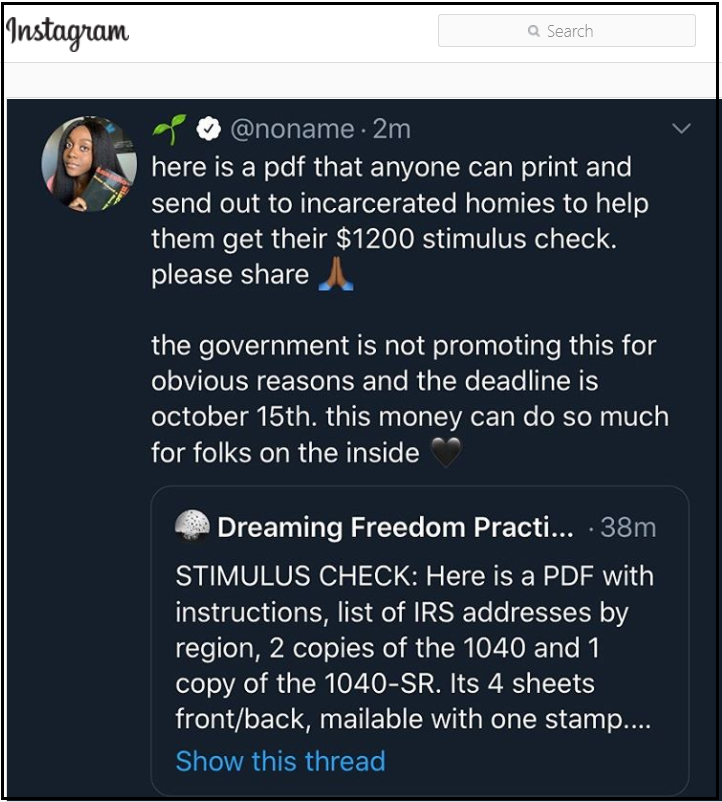

The claim appeared as a post (archived here) on Instagram, where it was published by an account No Name Hiding on October 3, 2020. It opened:

Here is a PDF that anyone can print and send out to incarcerated homies to help them get their $1200 stimulus check. Please share

the government is not promoting this for obvious reasons and the deadline is October 15. This money can do so much for folks on the inside

This is what the post looked like on Instagram at the time of writing:

(Source: Instagram screenshot taken on Mon Oct 5 21:26 2020 UTC)

The Instagram post links to a website, Abolitionist Study, with the headline, "DREAMING FREEDOM PRACTICING ABOLITION" and the subhead, "Urgent: Stimulus Check Forms." The post says:

Hello comrades! We have just learned that everyone locked up in a US prison is eligible for the $1200 stimulus check. Remember that check? The one we are all supposed to be living on months later? Anyway, it's a lot of money for our friends, family and comrades inside... But they only have until October 15 to send in a form (1040) to the IRS."

While the post on Instagram links to a website that is specifically about Pennsylvania inmates, inmates in all 50 states are eligible for the stimulus check because the court ruling came in a nationwide class-action suit.

The lawsuit was filed on August 1, 2020, by Lieff, Cabraser, Heimann & Bernstein and the Equal Justice Society as a class action against the United States Department of the Treasury and Internal Revenue Service in the United States District Court for the Northern District of California. The lawsuit was for the class of people across the country who were incarcerated at any time from March 27, 2020, to the present, serving a sentence in state or federal prison. According to the law firm's web page, "the lawsuit seeks to have a court order the Defendants to issue CARES Act stimulus relief to all eligible incarcerated people, or up to $1,200 per eligible person plus $500 per qualifying child."

The Coronavirus Aid, Relief and Economic Security (CARES) Act is the $2.2 trillion economic stimulus plan passed by Congress and signed into law by President Donald Trump to counteract the impact of the COVID-19 pandemic in the U.S.

According to the court documents, the "order granting motion for preliminary injunction and motion for class certification," states the U.S. Treasury Department and the IRS must stop withholding the $1,200 CARES ACT stimulus check from "class member on the sole basis of their incarcerated status."

PRELIMINARY INJUNCTION Defendants Steven Mnuchin, in his official capacity as the Secretary of the U.S. Department of Treasury; Charles Rettig, in his official capacity as U.S. Commissioner of Internal Revenue; the U.S. Department of the Treasury; the U.S. Internal Revenue Service; and the United States of America, are hereby enjoined from withholding benefits pursuant to 26 U.S.C. § 6428 from plaintiffs or any class member on the sole basis of their incarcerated status. Within 30 days, defendants shall reconsider advance refund payments to those who are entitled to such payment based on information available in the IRS's records (i.e., 2018 or 2019 tax returns), but from whom benefits have thus far been withheld, intercepted, or returned on the sole basis of their incarcerated status. Within 30 days, defendants shall reconsider any claim filed through the "non-filer" online portal or otherwise that was previously denied solely on the basis of the claimant's incarcerated status. Defendants shall take all necessary steps to effectuate these reconsiderations, including updates to the IRS website and communicating to federal and state correctional facilities. Within 45 days, defendants shall file a declaration confirming these steps have been implemented, including data regarding the number and amount of benefits that have been disbursed.

The injunction will remain in effect until a resolution of this action on the merits. IT IS SO ORDERED. Dated: September 24, 2020."

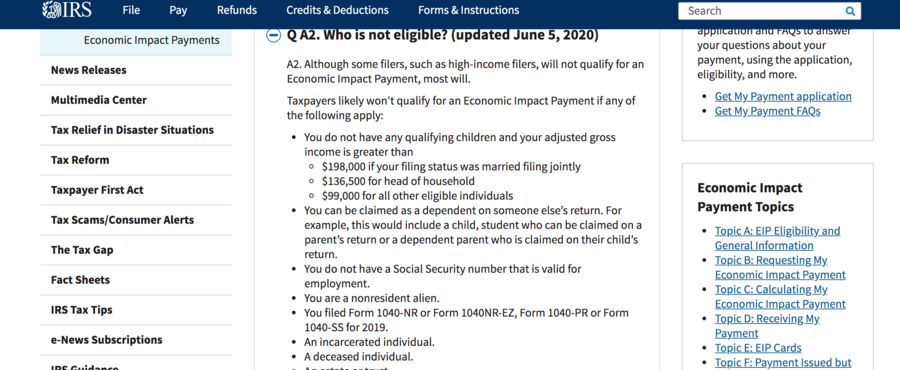

According to the IRS website, an incarcerated individual was not eligible to receive funds as of June 5, 2020.

The court order instructs the IRS to update its website with this information but as of October 5, 2020, the information was not updated. The deadline to confirm the instructions in the order was "within 45 days," of September 24, 2020, which is Monday, November 8, 2020.

The Lieff Cabraser Heimann & Bernstein website notes the IRS set a deadline of October 15, 2020 to file a claim for the stimulus check either electronically or by regular mail.