Does a social media post show a legal way around income taxes on tips? No, that's not true. The IRS says "All cash and non-cash tips" are income and are subject to federal income taxes. States with income taxes may also tax gratuities. Declaring the tip a "gift" doesn't change that responsibility.

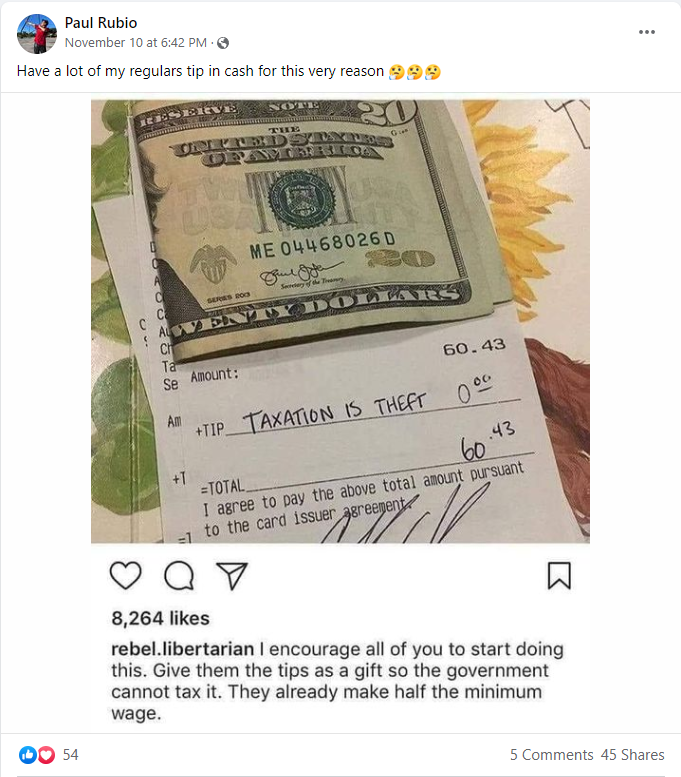

The claim appeared in a post (archived here) published on Facebook on November 10, 2021, which says "Have a lot of my regulars tip in cash for this very reason ..." Below, it shows the image of a receipt with 0.00 filled in for the tip amount and a note on the tip line saying "TAXATION IS THEFT." It opens:

I encourage all of you to start doing this. Give them the tips as a gift so the government cannot tax it. They already make half the minimum wage.

This is what the post looked like on Facebook on November 16, 2021:

(Source: Facebook screenshot taken on Tue Nov 16 21:32:31 2021 UTC)

The IRS website spells out its policy on the Tip Recordkeeping & Reporting page:

Tips are discretionary (optional or extra) payments determined by a customer that employees receive from customers.

Tips include:

- Cash tips received directly from customers.

- Tips from customers who leave a tip through electronic settlement or payment. This includes a credit card, debit card, gift card or any other electronic payment method.

- The value of any noncash tips, such as tickets or other items of value.

- Tip amounts received from other employees paid out through tip pools, tip splitting, or other formal/informal tip sharing arrangement.

Legally, leaving cash does not make it any less a tip, according to the IRS:

All cash and non-cash tips ... received by an employee are income and are subject to Federal income taxes. All cash tips received by an employee in any calendar month are subject to social security and Medicare taxes and must be reported to the employer. If the total tips received by the employee during a single calendar month by a single employer are less than $20, then these tips are not required to be reported and taxes are not required to be withheld. Cash tips include tips received from customers, charged tips (e.g., credit and debit card charges) distributed to the employee by the employee's employer and tips received from other employees under any tip-sharing arrangement. Tips also include tips received by both directly and indirectly tipped employees.

Also, calling the cash left behind a "gift" does not change anything. It cannot simply be called a gift. It has to qualify as one. Here's what the IRS says on its Frequently Asked Questions on Gift Taxes page about it:

What is considered a gift?

Any transfer to an individual, either directly or indirectly, where full consideration (measured in money or money's worth) is not received in return.

Because the cash is left in response to a product or service being provided, it cannot qualify as a gift no matter what the customer calls it.