Did former President Donald Trump pass a bill in 2017 that increased tax rates for taxpayers making $75,000 or less starting in 2021 and ending in 2027? No, that's not true: Although an analysis of the 2017 Tax Cuts And Jobs Act (TCJA) suggested that the tax rate would increase for low-income earners in 2021, that analysis is misleading.

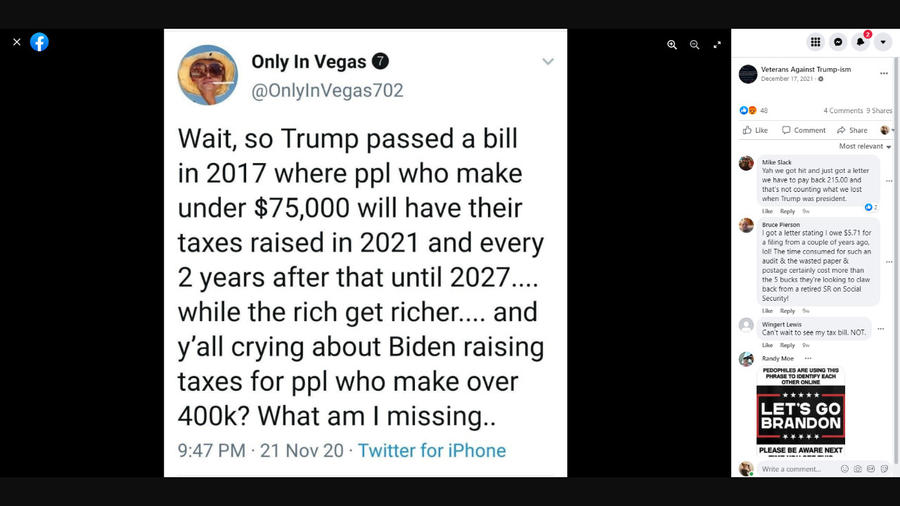

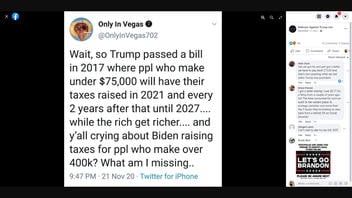

The claim appeared in a Facebook post (archived here) published on December 17, 2021. The post included a screenshot of a tweet that reads:

Wait, so Trump passed a bill in 2017 where ppl who make under $75,000 will have their taxes raised in 2021 and every 2 years after that until 2027.... while the rich get richer.... and y'all crying about Biden raising taxes for ppl who make over 400k? What am I missing..

This is what the post looked like on Facebook on February 22, 2022:

(Source: Facebook screenshot taken on Tue Feb 22 20:49 2022 UTC)

According to the Twitter thread from the user who published the tweet, the claim was made based on an opinion article published by The New York Times and written by Joseph Stiglitz, a Nobel laureate in economics. The article cited information (shown in a screenshot from the Tax Foundation here) from the Joint Committee on Taxation (JCT) to support its assertion of the tax increase. Stiglitz said:

People with incomes between $10,000 and $30,000 -- nearly one-quarter of Americans -- are among those scheduled to pay a higher average tax rate in 2021 than in years before the tax 'cut' was passed.

However, other independent, nonpartisan tax experts did not share this perspective. Both the Tax Foundation and the Urban-Brookings Tax Policy Center reported that the TCJA allowed for tax cuts for most individuals between 2018 and 2025. In an article published on November 18, 2020, by Garrett Watson, a senior policy analyst at the Tax Foundation, Watson explained that a change to the Affordable Care Act's individual mandate played a role in the figures presented by the JCT:

The TCJA reduced the Affordable Care Act's (ACA) individual mandate to $0, thus reducing the incentive to purchase qualified insurance and receive related premium tax credits, particularly for lower-income individuals. The reduction in premium tax credits appears as a tax increase for low-income individuals in the JCT distribution tables.

While it is important to consider the impact of the TCJA on premium tax credits and health insurance take-up, it is misleading to call this effect a 'stealth tax increase.' The decline in premium tax credits has nothing to do with a change in tax rates or the generosity of the credits as established under the ACA, but rather due to voluntary decisions individuals make about whether to purchase qualified health insurance.

In an email to Lead Stories on February 22, 2022, Kyle Pomerleau, a senior fellow at the American Enterprise Institute who studies federal tax policy, reaffirmed that the TCJA actually cuts taxes for most individuals from 2018 to 2025. He explained that there are tax increases for businesses between 2020 and 2025:

For example, this year, the tax treatment of research and development costs and interest expense will change, raising taxes on businesses. In 2023, the tax treatment of capital investments will worsen, further raising taxes.

However, Pomerleau noted that implementation of the TCJA still resulted in tax cuts for businesses in aggregate:

To be clear, these 'tax increases' somewhat offset the tax cuts for businesses-on net businesses still receive a tax cut. And since businesses are primarily owned by high-income households, these tax increases will offset the tax cuts these households are receiving.