Does a section of the U.S. Code, cited in a video on social media, exempt American workers from paying taxes? No, that's not true: No section of the U.S. Code universally exempts American workers from paying taxes. The section of the U.S. Code highlighted in the video pertains to the taxation of federal reserve banks, not individuals.

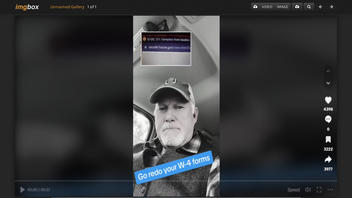

The claim appeared in a post and video (archived here) published on TikTok by Sagelife62 on October 2, 2023, under the title "Go redo your W-4 forms." The post's caption said:

#taxes #taxationwithoutrepresentation #taxes2023 #fuckthegoverment #conservatives

This is what the post looked like on TikTok at the time of writing:

(Source: TikTok screenshot taken on Thu Nov 9 15:29:23 2023 UTC)

The video

In the 37-second video on TikTok, a bearded man in a ball cap nods approvingly as a narrator in an inset clip lays out his case, suggesting that American workers don't have to pay taxes. Here's what was said:

Narrator: Betcha didn't know this. 12 USC 531: Exemption from taxation under uscode.house.gov.

What's it say? In effect, October 1st, 2023.

Exempt from taxation: Federal Reserve Banks, including the capital stock and surplus therein and the income derived therefrom shall be exempt from federal, state, and local taxation.

Bearded man: Go to your employer. Redo your W-4s.

The video embedded in the clip (archived here) was posted to TikTok on October 2, 2023, by Frank Viola326. You can watch it below:

@frankster515 #taxes #freeloader #federalreserve #maga #10/1/23 #notforyou #citystate #governmentbs ♬ original sound - Frank Viola326

U.S. Code

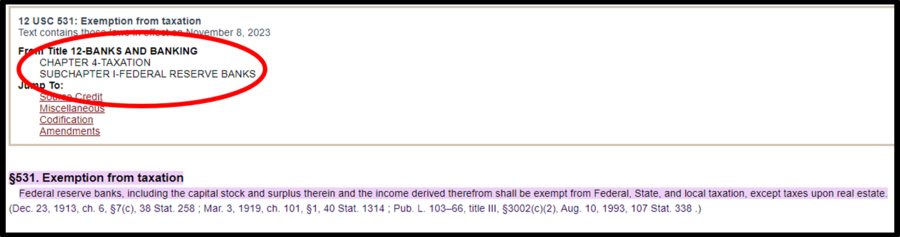

The video cites a section of the U.S. Code known as 12 USC 531: Exemption from taxation. A screenshot of this portion of U.S. law appears below:

(Source: U.S. Code screenshot taken on Thu Nov 9 18:43:22 2023 UTC)

While the video correctly quotes the law (highlighted in purple above), it has nothing to do with American workers being exempt from taxation. This section of the U.S. Code is called "Title 12-BANKS AND BANKING" and it pertains to the taxation of federal reserve banks, not the taxation of people.

Internal Revenue Service

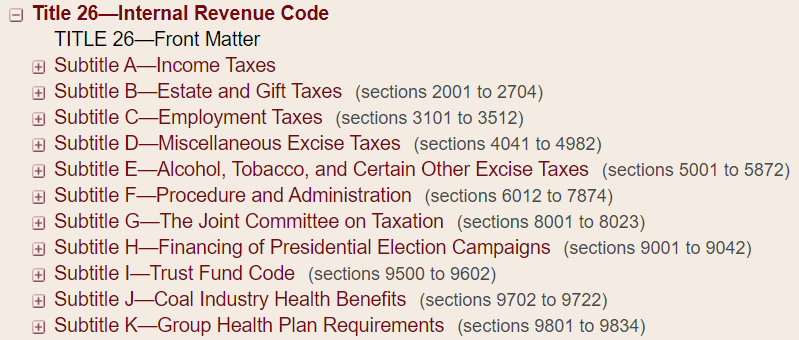

The section of the U.S. Code about income taxes falls under Title 26, also known as the Internal Revenue Code. A screenshot of Title 26 can be seen below:

(Source: US Code screenshot taken on Thu Nov 9 19:46:34 2023 UTC)

Read more

Other Lead Stories fact checks involving taxation and the Internal Revenue Service (IRS) can be seen here.