Does a graph showing "loan locks" for non-permanent residents applying for FHA mortgages prove that immigrants overpaying for homes has inflated U.S. housing prices? No, that's not true: Non-permanent residents who applied for FHA loans were "not a major factor in the vast majority of local housing markets in the U.S.," according to a researcher with the company that produced the graph. A recent rise in the share of FHA loans to non-permanent residents is "partly a denominator effect," because fewer U.S. citizens were applying for FHA loans, the researcher said.

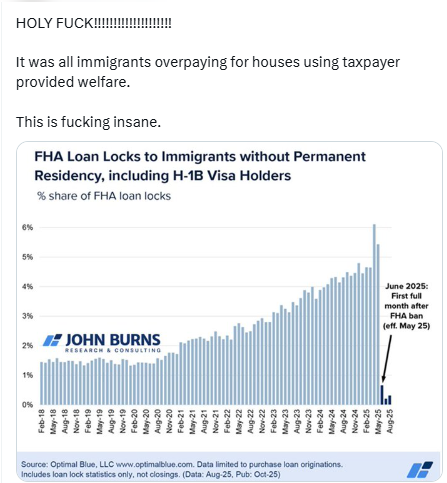

The claim appeared in a post (archived here) shared the @VladTheInflator account on X by on October 15, 2025. The post included a graph that was introduced by a caption that read:

HOLY FUCK!!!!!!!!!!!!!!!!!!!!

It was all immigrants overpaying for houses using taxpayer provided welfare.

This is fucking insane.

This is what the post looked like at the time of writing:

(Image source: Lead Stories screenshot of X.com)

The post included a graph titled "FHA Loan Locks to Immigrants without Permanent Residency, including H-1B Visa Holders" that was based on data collected in August by Optimal Blue, a mortgage data platform, and was published in October by John Burns Research and Consulting.

Eric Finnigan, vice president of demographics research for John Burns Research and Consulting, said in an email to Lead Stories that a "loan lock" is not a loan, but "a step before final approval" of a mortgage application. It secures the interest rate in the event the loan gets final approval:

A borrower can obtain a loan lock in order to guarantee a specific interest rate and terms for 30 to 90 days while they finish their loan application. You might hear someone talk about it as they 'locked in a rate.' Basically it protects from rate increases, but it's not a final approval. They still need to pass underwriting and meet all conditions.

HIs company tracks loan lock statistics because "it's a helpful metric because mortgage loan lock trends will sometimes lead trends in actual mortgage issuance."

Finnigan said that the implied claim in the X post that non-permanent residents using FHA loans have caused housing prices in the U.S. to rise is wrong and those purchases are "not a major factor in the vast majority of local housing markets in the U.S. He listed three main reasons:

- U.S. citizens and permanent residents are normally ~98% of FHA borrowers. Last year they were 96%. This extra 2% of FHA borrowers are not a major factor in most areas. FHA loans funded ~12% of 2024's home sales. So we're dealing with a fraction of a fraction, in terms of impact.

- There are vastly different impacts across various local markets. In the majority of the top 10 MOST impacted markets, home prices have been falling for roughly the past year or more -- way before any of 2025's policy shifts. If FHA loans to non-permanent residents were inflating home prices, we'd see rising prices instead falling prices.

- The recent rise in loan share to non-permanent residents is partly a denominator effect -- loan demand by U.S. citizens has been falling relative to loan demand by non-permanent residents, which drives up the share of loans to non-permanent residents.

The Trump administration's Department of Housing and Urban Development ended (archived here) FHA mortgage eligibility for non-permanent residents, including H-1B visa holders, as of May 25, 2025.