Did President Donald Trump signal that he will "take away your Social Security" with his remarks that he may make a payroll tax deferment permanent? No, that's not true: President Trump signed an order for the deferral of some payroll taxes, which fund Social Security, during the COVID-19 pandemic, and he has thrown around the idea of removing the tax altogether. But Trump also suggested the program could be funded through the Federal government's general fund. Trump has said on multiple occasions he will "protect" and "save" Social Security.

The claim appeared as a meme in a post (archived here) on Facebook on October 28, 2020, under the title "ALERT: In August, Trump vowed to PERMANENTLY end Social Security's dedicated funding, without which the Social Security Administration has said the program would go bankrupt by 2023 (!!!) unless Congress acts. THIS IS RED-ALERT, FOLKS! Follow Ridin' With Biden to defeat Trump and save OUR Social Security!" The meme said:

Joe Biden will not take your guns, but Trump will take away your Social Security. Pass it on.

This is what the post looked like on Facebook at the time of writing:

(Source: Facebook screenshot taken on Fri Oct 30 18:03:54 2020 UTC)

Claims about Trump doing away with Social Security really got going following an interview he did with CNBC on January 22, 2020. CNBC's Joe Kernen asked him:

Entitlements ever be on your plate?

Trump responded:

At some point they will be.

Democrats viewed this as a reference to Social Security, along with Medicare and Medicaid.

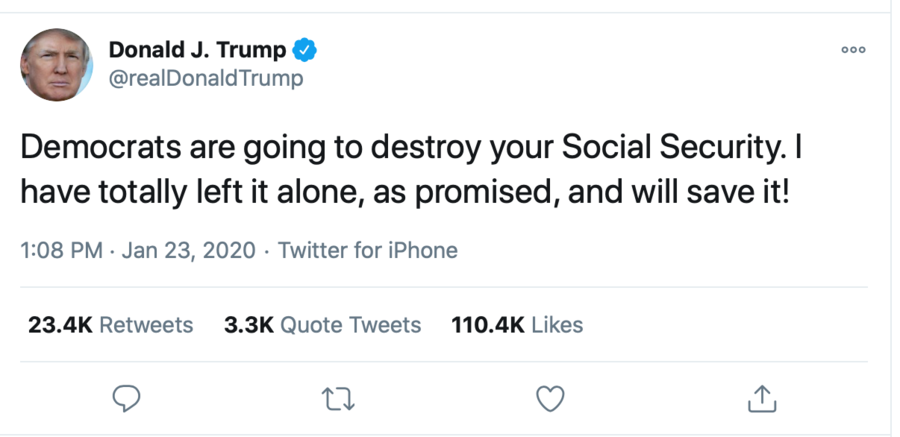

Trump soon responded to the claims on Twitter, by saying:

Democrats are going to destroy your Social Security. I have totally left it alone, as promised, and will save it!

But it was remarks Trump made in August and an Executive Order he signed that the Facebook post by a pro-Joe Biden account called Ridin' With Biden, appears to be referring to.

On August 8, 2020, during a press briefing in Bedminster, New Jersey, Trump announced that in order to offer some relief during the COVID-19 pandemic, he would be "providing a payroll tax holiday to Americans earning less than $100,000 per year."

Later, he added:

But if I win, I may extend and terminate. In other words, I'll extend it beyond the end of the year and terminate the tax. And so, we'll see what happens. Biden probably won't be doing that; you'll have to ask him. I don't think he knows what he's doing.

According to the Social Security Administration, the insurance program is primarily financed through payroll taxes. It explained:

In 2019, $944.5 billion (89 percent) of total Old-Age and Survivors Insurance and Disability Insurance income came from payroll taxes.

The same day Trump made those remarks about the insurance program, he signed an Executive Order known as the "Deferring Payroll Tax Obligations in Light of the Ongoing COVID-19 Disaster." It is expected to postpone these tax payments for some employees from September 1, 2020, through December 31, 2020.

The U.S. Congress's Committee on Ways and Means clarified in a statement on its website that since the taxes have simply been deferred, the Executive Order will not impact Social Security's Trust Funds. The committee also said:

The Social Security Chief Actuary has confirmed that no one has proposed legislation to zero-out Social Security payroll taxes, and that past payroll tax holidays enacted by President Obama provided General Fund transfers to offset effects on Social Security's trust funds.

However, the executive order does say the Secretary of the Treasury, Steven Mnuchin, is expected to explore "avenues, including legislation, to eliminate the obligation to pay" the deferred taxes.

On August 13, Trump clarified his remarks on Social Security and the executive order during a press briefing, saying if he is awarded a second term, he will forgive those deferred payroll taxes, but he will do it in a way that does not hurt Social Security. He explained that money will instead come from the General Fund. He added:

We're not going to touch Social Security. I said from day one that we're going to protect Social Security, and we're going to protect our people. And Social Security is one of the things that will be protected.

In a letter sent by Stephen C. Goss, the Social Security Administration's Chief Actuary, on August 24, 2020 to U.S. Senators, he said:

If this hypothetical legislation were enacted, with no alternative source of revenue to replace the elimination of payroll taxes on earned income paid on January 1, 2021 and thereafter, we estimate that DI Trust Fund asset reserves would become permanently depleted in about the middle of calendar year 2021, with no ability to pay DI benefits thereafter. We estimate that OASI Trust Fund reserves would become permanently depleted by the middle of calendar year 2023, with no ability to pay OASI benefits thereafter.

The Facebook meme also claims that Democratic Presidential Candidate Joe Biden "will not take your guns." That's mostly true. According to Biden's campaign website, his gun policies center more on requirements before a firearm is actually in someone's possession, as well as regulations once someone does own a gun. But he is advocating for an program to require gun-owners who commit a crime to relinquish their gun(s) and lose their right to own guns. Lead Stories contacted the White House press office and will update this when they respond, if appropriate.

Politifact and Snopes debunked a similar claim about Social Security.