Does Congress' infrastructure bill include a 61% death tax on an individual's entire accumulated wealth and estate? No, that's not true: The American Families Plan designed by the Biden administration proposed two tax increases that suggested a death tax of about 61% for only the nation's wealthiest individuals. That measure has not been included in Congress' infrastructure act.

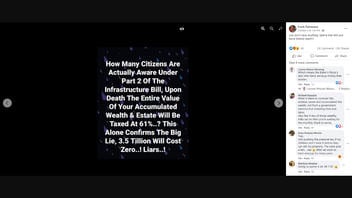

The claim appeared in a Facebook post (archived here) published on October 6, 2021. It includes a graphic that reads:

How Many Citizens Are Actually Aware Under Part 2 Of The Infrastructure Bill, Upon Death The Entire Value Of Your Accumulated Wealth & Estate Will Be Taxed At 61%..? This Alone Confirms The Big Lie, 3.5 Tillion Will Cost Zero..! Liars..!

This is what the post looked like on Facebook at the time of writing:

(Source: Facebook screenshot taken on Thu Oct 14 20:37:57 2021 UTC)

The American Families Plan, announced by the administration in April 2021, focused on measures that assist families and encourage widespread health care and education. Strategies to increase the top tax rate to 39.6% for the country's wealthiest individuals and to end capital income tax breaks and loopholes for that same demographic were included in the plan.

However, the plan has not become law, and Congress has not included the tax measures in its Infrastructure Investment and Jobs Act, which is in development at the time of writing. There is a possibility that the post making the claim conflated the American Families Plan with the infrastructure act because the former was unveiled as a part of the Biden administration's Build Back Better Agenda. The agenda initially included the American Families Plan; the American Jobs Plan, which zeroed in on infrastructure; and the American Rescue Plan, which did become law and provided emergency COVID-19 aid for Americans. The infrastructure act and Congress' reconciliation bill, pending at the time of writing, known as the Build Back Better Act, are the result of Congress' restructuring of the Build Back Better Agenda.

In an email to Lead Stories on October 14, 2021, Garrett Watson, a senior policy analyst at the Tax Foundation, provided more tax-specific information about the claim:

This claim is likely referencing the budget reconciliation process in Congress, or President Biden's American Families Plan (AFP), which included a proposal to tax unrealized capital gains at death above $1 million. We found that under the AFP, the effective tax rate on the estates of the wealthy could be as high as 61 percent if you include both that proposal and the current law estate tax.

The effective rate could be as high as 61 percent when including the estate tax and taxing unrealized capital gains at death under President Biden's tax plan. However, taxpayers who have lower levels of wealth would not be subject to one or both of the estate tax and taxing unrealized capital gains at death. Only unrealized gains over $1 million ($2 million for joint filers) would be subject to that tax, and the estate tax kicks in over $11.7 million. The 61 percent effective tax rate would not apply to taxpayers writ-large.

The tax proposals under the House Ways & Means Committee (separate from the bipartisan infrastructure bill) did not include a tax on unrealized capital gains at death, which suggests that this proposal may not make it to the final package. The Senate Finance Committee has not yet released their own tax proposals, though, so it could still be included later on. If unrealized capital gains are not taxed, then only the current law estate tax would apply and the effective tax rate would be lower than 61 percent. Currently, the estate tax applies to estates over $11.7 million per person and at a 40% tax rate.

Lead Stories reached out to the Committee for a Responsible Federal Budget for comment and will update this fact check with any response.

Some previously debunked claims about points in the Biden administration's Build Back Better Agenda from Lead Stories can be found here and here.