Does the U.S. government want to tax unrealized gains -- specifically "equity gains" on unsold homes -- for everyday Americans? No, that's not true: If enacted, a proposed tax on unrealized gains by President Joe Biden would only apply to Americans whose net worth is $100 million or more. According to the White House, that only applies to about 0.01% of American households.

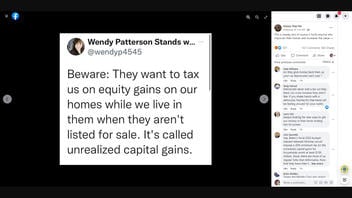

The claim appeared in a Facebook post (archived here) on March 30, 2022. The post has a screenshot of text that reads:

Beware: They want to tax us on equity gains on our homes while we live in them when they aren't listed for sale. It's called unrealized capital gains.

This is what the post looked like on Facebook on March 31, 2022:

(Source: Facebook screenshot taken on Thu Mar 31 17:08 2022 UTC)

The tax referenced in the post only applies to a minuscule population of Americans. On March 28, 2022, the Biden administration released information about its plan to propose the "Billionaire Minimum Income Tax" for the fiscal year 2023 budget. According to the press release, this tax would apply to the United States' top earners and their realized and unrealized gains:

The Billionaire Minimum Income Tax will ensure that the very wealthiest Americans pay a tax rate of at least 20 percent on their full income, including unrealized appreciation. This minimum tax would make sure that the wealthiest Americans no longer pay a tax rate lower than teachers and firefighters.

The tax will apply only to the top one-one hundredth of one percent (0.01%) of American households (those worth over $100 million). Over half of the revenue will come from households worth more than $1 billion.

In an email to Lead Stories on March 31, 2022, Garrett Watson, a senior policy analyst at the Tax Foundation, confirmed that the tax only concerns the wealthiest Americans and their gains:

The White House proposal to tax unrealized capital gains would only apply to households with net wealth of $100 million or more (separate from annual earnings). Those unrealized gains would presumably include the appreciation of real estate held by taxpayers it applies to, as the Treasury document outlining the tax details do not mention any exemptions for residences. However, none of these details would matter for most households, because they are not subject to the tax unless they have a net worth of $100 million or more

However, in another analysis, Howard Gleckman, a senior fellow at the Urban-Brookings Tax Policy Center, told Lead Stories in an email on March 31, 2022, that the tax would most likely not apply to illiquid assets such as a house:

Even for those households affected by the new annual tax, it would apply generally only to 'tradeable assets' such as stocks and bonds. Illiquid assets (like a house) would either be exempt or treated under a separate set of rules.

Gleckman also explained that the tax would be considered a prepayment of capital gains taxes:

If someone pays the tax annually, they would not be taxed again when they actually sell the asset. And people would have several years to pay even the annual tax.

Other Lead Stories fact checks about tax policies enacted during the Biden administration can be found here, here, here and here.