Did President Joe Biden sign a bill creating a 45% capital gains tax? No, that's not true: In order for the president to sign such a bill, both houses of Congress would have first have to have passed it. Lead Stories searched for such a bill on Congress. gov, which allows a user to track a bill's status. We found no such bill that had been introduced, passed or signed regarding the federal capital gains tax. A president cannot raise taxes by signing an executive order. Article I, Section 8 of the U.S. Constitution gives Congress the power to levy taxes.

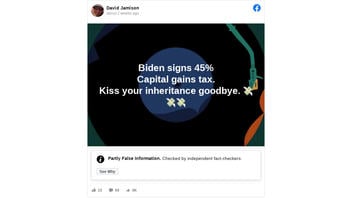

The claim appeared in a Facebook post (archived here) published February 1, 2021, which opened:

Biden signs 45%

Capital gains tax.

Kiss your inheritance goodbye.

This is what the post looked like on Facebook at the time of writing:

(Source: Facebook screenshot taken on Fri Feb 12 22:57:48 2021 UTC)

Since the Facebook post mentions capital gains tax and alludes to the estate and gift tax, it appears the claim is referring to the tax plan Biden first proposed during his presidential campaign. If so, the information presented in the post is incorrect.

Biden's plan would raise the top rate for the estate tax to 45%, according to an analysis of the plan done by the Tax Foundation, "an independent tax policy nonprofit." The rate is currently 40%.

Biden has also proposed raising the capital gains tax for taxpayers with incomes above $1 million to a top rate of 39.6%. The current top rate is 20%. A capital gains tax is paid on the profit realized on the sale of assets, such as a home or investments, including stocks and bonds, etc.