Is it true that debt collection agencies cannot buy your debt and "come after you" without your written consent? No, that's not true: Although they must follow strict communication guidelines, debt collectors can purchase debt and pursue debt collection without written consent from a consumer.

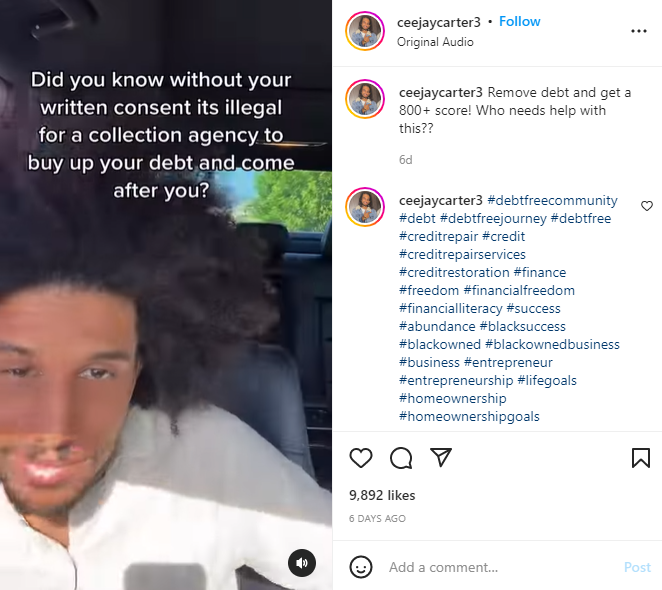

The claim appeared in an Instagram post on July 20, 2022. The post features a video, which opens:

Did you know without your written consent its illegal for a collection agency to buy up your debt and come after you?

This is how the post looked on Instagram at the time of writing:

(Source: Instagram screenshot taken on Wed Jul 27 14:55:24 2022 UTC)

Lead Stories previously published a fact check that explains how debt collection works: It is perfectly legal for debt collectors to buy debt, as well as reach out to and take legal action against a consumer, but they must follow strict communication guidelines. Debt collectors are not allowed to harass, lie to or act unfairly toward consumers. They also can only contact consumers at certain hours of the day. One guideline stipulates that a consumer can ask a debt collector to stop contacting them. However, in that situation, the debt collector can still notify the consumer once more to alert them that they will take legal action against them for not yet paying back a verified debt.

In the Fair Debt Collection Practices Act, the only mentions of the word "consent" are in reference to how debt collectors communicate with consumers. There is no mention of "written consent" required for debt collectors to pursue collection.

The video posted to Instagram also claimed that you can remove items like student loans and old bills from a credit report without paying them off. But in most circumstances, that isn't the case. Most current, negative but accurate information on a credit report will stay there, according to a resource from the Consumer Financial Protection Bureau. The bureau cautions that anyone who claims to be able to take away current, negative but accurate information on a credit report is probably running a credit repair scam.