Did the French left-wing coalition announce that it would introduce a "90% TAX on anyone earning €400,000," leaving those taxpayers with "just €40,000"? No, that's not true: According to Eric Coquerel of the left-wing New Popular Front, the rate of 90 percent is planned to apply to the amounts that exceed a certain income bracket. Claims on social media incorrectly summarize the proposal.Those tax brackets don't appear to have been entirely set in stone as of this writing.

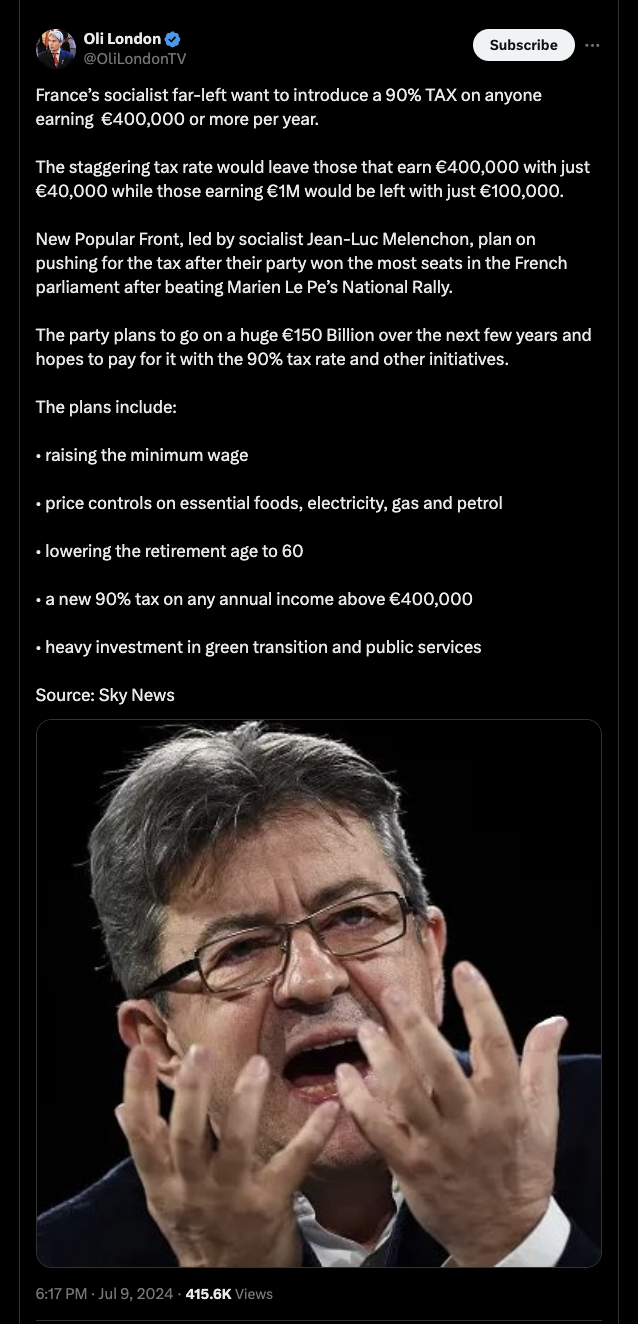

The claim appeared in a post (archived here) on X, formerly known as Twitter, on June 9, 2024. It began:

France's socialist far-left want to introduce a 90% TAX on anyone earning €400,000 or more per year.

The staggering tax rate would leave those that earn €400,000 with just €40,000 while those earning €1M would be left with just €100,000.

New Popular Front, led by socialist Jean-Luc Melenchon, plan on pushing for the tax after their party won the most seats in the French parliament after beating Marien Le Pe's National Rally.

This is what it looked like at the time of writing:

(Source: X screenshot taken on Wed Jul 10 14:42:56 2024 UTC)

As seen in the screenshot above, the post contradicted itself. "The staggering tax rate would leave those that earn €400,000 with just €40,000" is not the same as "a new 90% tax on any annual income above €400,000" listed closer to the end of the entry on X: The former implied that the rate would be applicable to the total of 400,000 euros ($433,002) while the latter clearly referred to the difference between 400,000 euros and what was earned above it.

As reported by Bloomberg (archived here), the specific rate of 90 percent was brought up by Eric Coquerel, a member of the left-wing New Popular Front coalition on June 23, 2024 -- two weeks before it surged (archived here) in the national legislative election that ended on July 7, 2024.

During that Cnews interview (archived here) -- a fragment from it was also shared on Coquerel's YouTube channel (archived here) -- he explained the proposal. As translated by Lead Stories French-speaking staff, Coquerel said at the 12:33 mark:

It's not 90 percent of the total sum. It's 90 percent of what goes over the bracket at some point, so it's 90 percent of a part of your revenues. The rest is obviously sequential, and a bracket corresponds to it.

Talking on TV, he did not name a specific amount after which the 90 percent rate would be enforced.

Bloomberg, however, pointed out that the proposal appears to have originated from a budget amendment his party attempted to pass in 2019. That document (archived here) suggested that the existing tax brackets should be adjusted and that the 90 percent rate would be applied to income exceeding 411,683 euros ($445,622).

As of this writing, the New Popular Front website (archived here) contained a document (archived here) outlining its economic program, among other items. It promised "to abolish the privileges of billionaires" on page eight, but page 13, which went into detail, did not mention the rate of 90 percent and did not offer an amount over which it would be applied. Instead, the program made a general reference to the 14 tax brackets -- a number that is consistent with the number of brackets from the 2019 proposal -- and said that a new "rectifying finance bill" aimed at "fair tax policy" would be adopted on August 4, 2024.

As of this writing, it is not clear whether such a measure can avoid a court challenge if it's passed.

No credible sources indexed by Google News via a search for keywords seen here (archived here) suggest that the 90 percent rate will be applied to the entirety of the annual income if a person makes 400,000 euros or above.

Other Lead Stories fact checks mentioning Europe can be found here.

International stories are here.