Does the Kamala Harris/Tim Walz campaign support a 25 percent tax on unrealized capital gains? Yes, but that's missing context: The tax would apply only to Americans with more than $100 million in wealth. The Harris/Walz campaign endorsed the Biden budget for 2025, which included the 25 percent tax on unrealized gains. Government documents state that the tax would only be paid by taxpayers who are worth $100 million or more. People with less than $100 million would not be taxed with that rate.

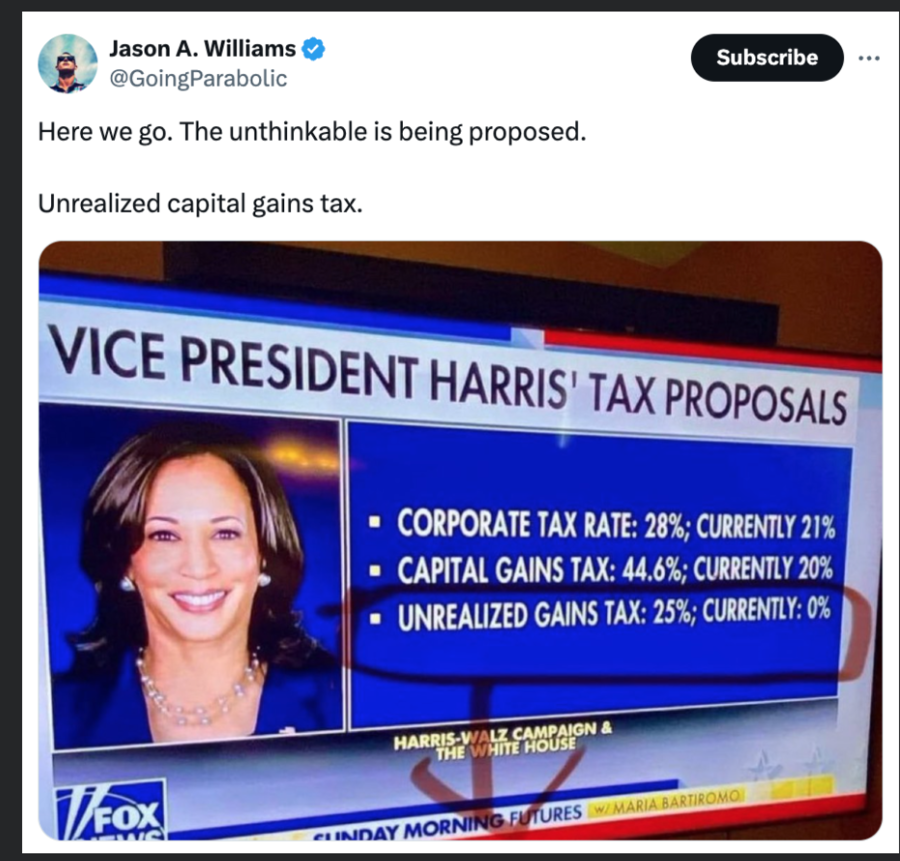

The claim appeared in a post (archived here) on X, formerly known as Twitter, on August 28, 2024. It said:

Here we go. The unthinkable is being proposed.

Unrealized capital gains tax.

This is what the post looked like on X at the time of writing:

(Source: X screenshot taken on Thurs Aug 29 16:53:29 2024 UTC)

The image in the post is a screenshot from the episode of Maria Bartiromo's Fox News show "Sunday Morning Futures" (archived here) that aired on August 25, 2024. At the 4:28 mark Bartiromo says:

Vice President Harris is also reportedly supporting President Biden's budget plan to raise the capital gains tax to 44.6 percent, the corporate tax rate to 28 percent, and reportedly institute a 25 percent tax on unrealized gains.

It's been 35 days and Harris has yet to release or discuss specific policy plans.

Bartiromo says Harris will "reportedly" institute the tax without citing the source of the report. The New York Times (archived here) and the Wall Street Journal (archived here) both reported that campaign aides said Harris supports President Joe Biden's tax proposal from early 2024, which included the 25 percent tax on unrealized capital gains for taxpayers who have more than $100 million.

The Department of the Treasury released the General Explanations of the Administration's Fiscal Year 2025 Revenue Proposal (archived here), Biden's budget (archived here), and detailed on page 91 that the 25 percent tax was only for extremely wealthy taxpayers. In the section titled "IMPOSE A MINIMUM INCOME TAX ON THE WEALTHIEST TAXPAYERS":

The proposal would impose a minimum tax of 25 percent on total income, generally inclusive of unrealized capital gains, for all taxpayers with wealth (that is, the difference obtained by subtracting liabilities from assets) greater than $100 million.

Investopedia (archived here) defines unrealized gains this way:

An unrealized gain is an increase in the value of an asset or investment that an investor has not sold, such as an open stock position.

Lead Stories has reached out to the Harris campaign and will update the story when a response is received.

Other Lead Stories fact checks on claims concerning Kamala Harris can be found here and our fact checks on claims regarding the 2024 election can be found here.