Does a video on social media offer any evidence of a program that gives people $20,000 so they can use the money to pay off their credit card debt? No, that's not true: The clip only showed two images of some bank account transactions of unknown origin. The Consumer Financial Protection Bureau told Lead Stories there is no such program that would provide a deposit of cash to pay off credit card bills.

The claim appeared in a video (archived here) on Facebook on December 8, 2024, under the title:

Credit Card Debt Loophole

The video's unidentified narrator said, in part:

My friend literally got fired last week from a major credit card company for revealing this trick. If you have credit, medical or personal loan debt, please please listen. As you can see, I was over $25,000 in debt, and I had a lot of high credit card balances. This program literally deposited over $20,000 into my bank account, and I was then able to use this money to pay down my high credit card balances. The best part is I did not have to pay this back, and it is not bankruptcy, it's not a loan. So please click the link and learn more today.

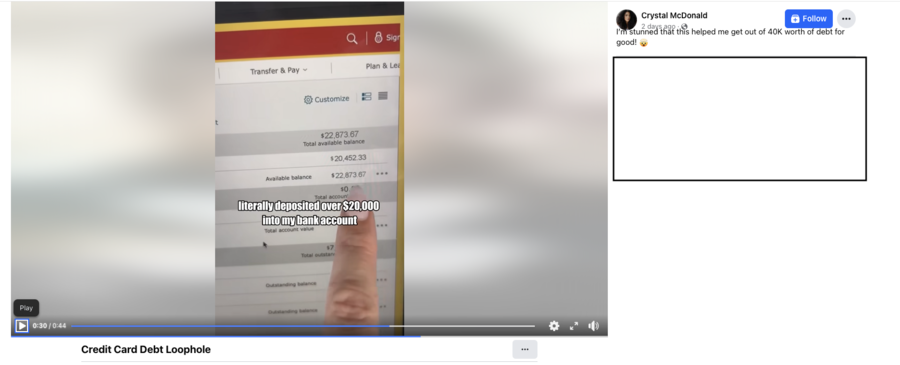

This is what a key scene from the video looked like on Facebook at the time of writing:

(Source: Facebook screenshot taken on Wed Dec 11 20:19:28 2024 UTC)

When asked about the video, a spokesperson for the federal Consumer Financial Protection Bureau (archived here) told Lead Stories via email on December 12, 2024:

There is no such program that would provide a deposit of cash into someone's bank account for you to pay off your credit card bills.

The spokesperson added that the federal agency had seen similar videos in the past used to "funnel leads to debt settlement companies who will contact the consumer" if a person enters their personal information. Then, "when they apply for the offered loan, the debt settlement company will cross sell them into a debt settlement plan."

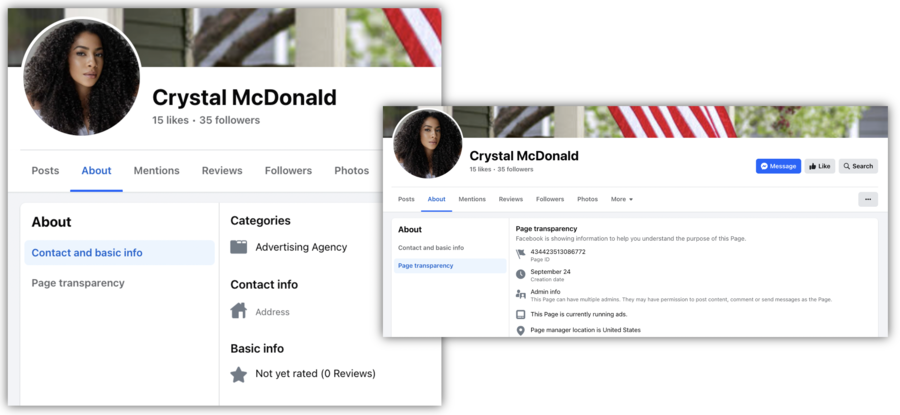

The account that posted the video had a name that sounded like an individual's name, but, according to the page's transparency tab, it was a self-described advertising agency whose contact information, such as a phone number or a website, was nowhere to be found. The page was created in September 2024 and was managed by multiple people:

(Sources: Facebook screenshots taken on Thu Dec 12 18:51:20 and 18:51:31 2024 UTC; composite image by Lead Stories)

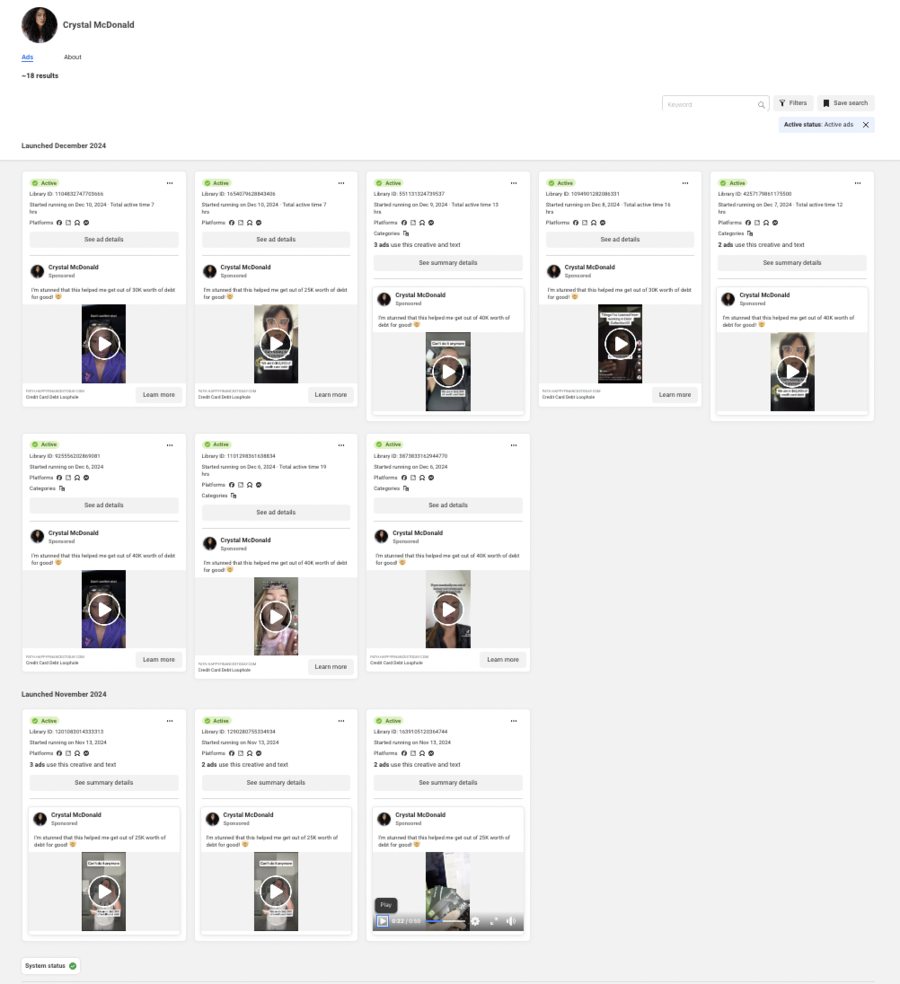

As of this writing, the page was running at least 11 advertising campaigns promoting variations of the same video. The clips made identical claims and showed largely the same content but the opening shots displayed different people:

(Source: Facebook screenshot taken on Thu Dec 12 16:06:21 2024 UTC)

Some of the promoted variations showed the "Learn more" button, which led to an article about "debt relief." The piece appeared on the website of a firm that says it offers debtors a "document generation tool" to respond to debt lawsuits and "an AI-powered tool for negotiating debt settlements outside of court."

The article said nothing about the purported $20,000 sent into debtors' bank accounts supposedly for free.

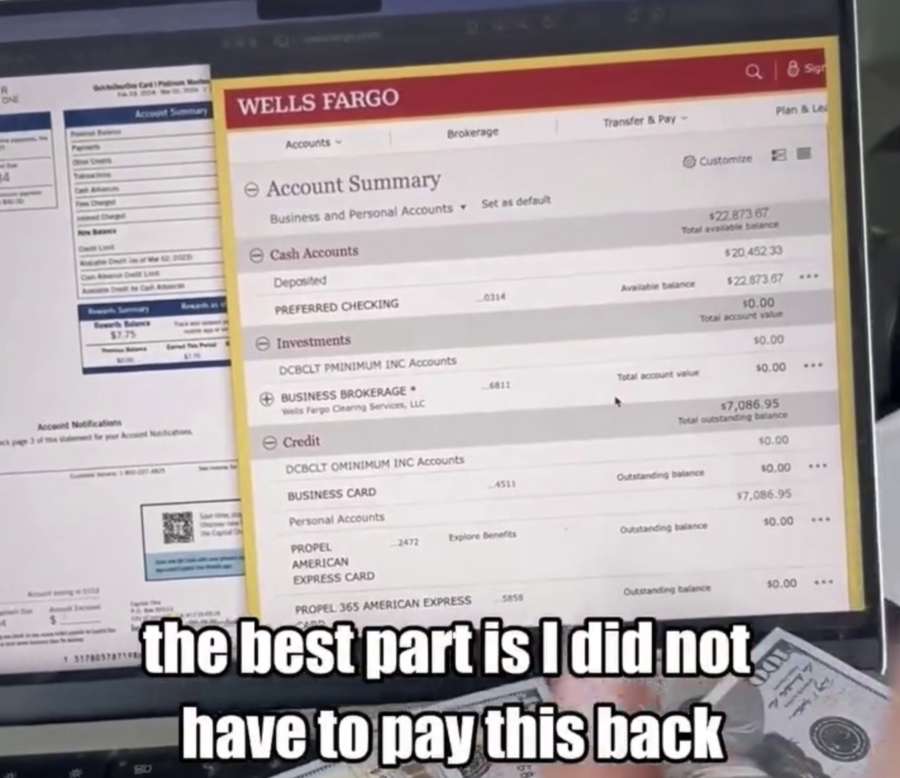

A better keyframe from the video produced by Lead Stories via InVID video verification revealed that the clip didn't show the source of the supposed transaction. Furthermore, it was unclear whether the amount of $20,452 reflected a one-time deposit or the total of multiple transactions that could have originated from loans, salary or other forms of income:

(Source: Facebook screenshot taken on Wed Dec 11 20:45:38 2024 UTC)

As the screenshot above demonstrates, the summary page of someone's Wells Fargo online accounts was a picture, not a live page: There was no visible link, and the appearance of the app used to open the image is consistent with Preview on Mac laptops.

A search across Google for the keywords seen here (archived here) returned articles describing a debt settlement process, which is sometimes referred to as "credit card debt forgiveness" (archived here) or one form of "debt relief" (archived here). That requires an escrow account (archived here) but no money will appear there on its own: It will be the customer making the payments to the escrow account. When there is enough money, debt settlement firms will try to use that sum to negotiate with credit card companies to write off a portion of debt and settle.

The website of the Consumer Financial Protection Bureau (archived here) reads:

Debt settlement may well leave you deeper in debt than you were when you started. Most debt settlement companies will ask you to stop paying your debts in order to get creditors to negotiate and in order to collect the funds required for a settlement. This can have a negative effect on your credit score and may result in the creditor or debt collector filing a lawsuit while you are collecting funds required for a settlement. And if you stop making payments on a credit card, late fees and interest will be added to the debt each month. If you exceed your credit limit, additional fees and charges may apply. This can cause your original debt to increase.

The website of the Federal Trade Commission (archived here) reads:

Debt relief service scams target consumers with significant credit card debt by falsely promising to negotiate with their creditors to settle or otherwise reduce consumers' repayment obligations. These operations often charge cash-strapped consumers a large up-front fee, but then fail to help them settle or lower their debts - if they provide any service at all.

While not all debt settlement companies are scams, the Office of the Texas Attorney General (archived here) explicitly warns about specific signs:

If the person/company offers to help get rid of your debt but first you have to pay them a fee, they're probably lying to you.

Other Lead Stories fact checks mentioning credit card debt can be found here.