Did President Donald Trump propose a law that says only the person who pays child support can claim a child on their taxes? No, that's not true: There's no proof Trump ever suggested this idea. The current tax rules, which include changes made under Trump's 2017 tax cuts set to expire in 2026, don't stop both parents from being able to claim their child on taxes if they qualify.

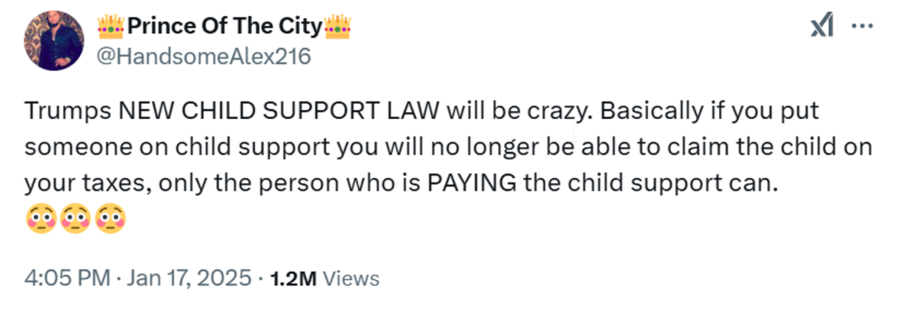

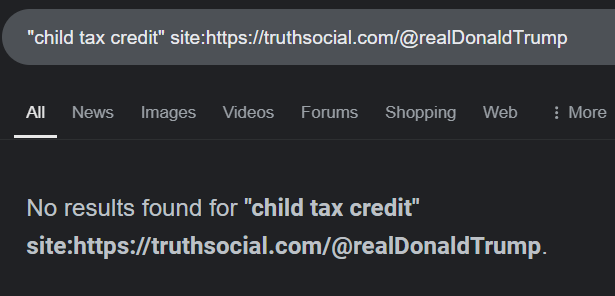

The claim appeared in a post (archived here) published on X on January 17, 2025. The post's caption said:

Trumps NEW CHILD SUPPORT LAW will be crazy. Basically if you put someone on child support you will no longer be able to claim the child on your taxes, only the person who is PAYING the child support can.

This is what the post looked like on X at the time of writing:

(Source: X screenshot taken on Tue Jan 21 20:01:56 2025 UTC)

This post provided no evidence to support the assertion that Trump proposed a law that says only the person who pays child support can claim a child on their taxes.

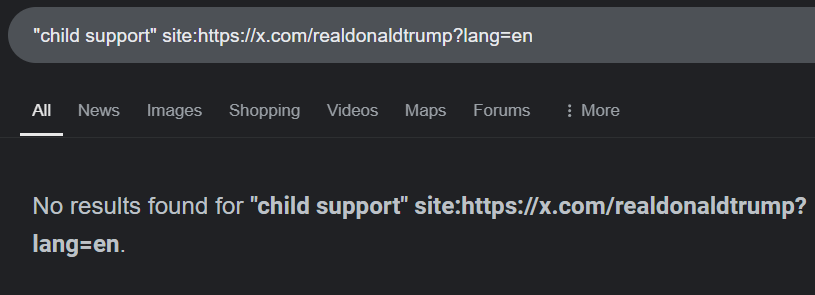

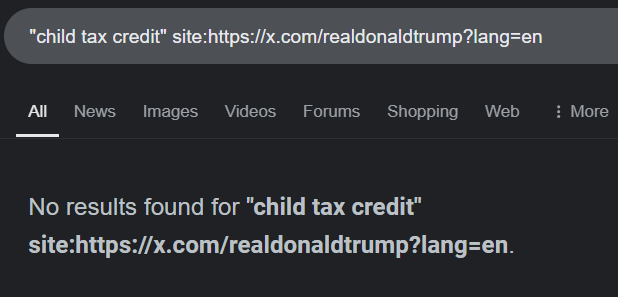

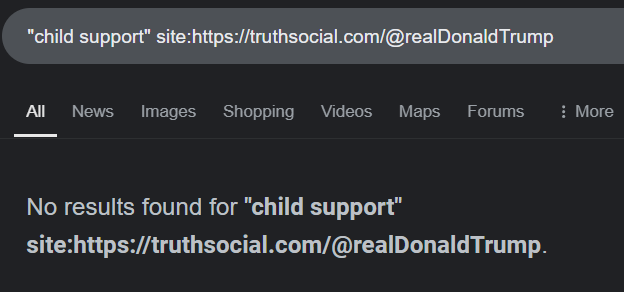

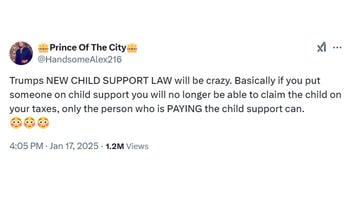

Trump social media

The president is very active on his social media accounts, including X and his own Truth Social platform. Using Google Advanced Search on January 21, 2025, Lead Stories found "no results" for the terms "child support" or "child tax credit" on either X or Truth Social.

A screenshot and link for each search result can be found below:

(Source: Google screenshot taken on Tue Jan 21 21:35:01 2025 UTC)

(Source: Google screenshot taken on Tue Jan 21 21:36:32 2025 UTC)

Truth Social - "child support":

(Source: Google screenshot taken on Tue Jan 21 21:38:08 2025 UTC)

Truth Social - "child tax credit":

(Source: Google screenshot taken on Tue Jan 21 21:39:23 2025 UTC)

Tax Cuts and Jobs Act

Trump's Tax Cuts and Jobs Act (archived here) legislation, passed by Congress in 2017 and set to expire in 2026, includes the child tax credit in effect when this story was written.

IRS Publication 4449 (archived here) says there's nothing in the tax code that states only the person who pays child support can claim a child on their taxes. Instead, the publication says parents who don't have custody but pay child support can claim a child tax credit if they meet all these guidelines:

Do you pay child support?

Child support payments are not tax deductible by the payer and they are not taxable income to the recipient. Paying child support does not necessarily entitle you to a dependency exemption.

Claiming Your Child as a Dependent

Generally, because of the residency test, a child of divorced or separated parents is the qualifying child of the custodial parent. However, the child will be treated as the qualifying child (for the purposes of claiming a dependency exemption and the child tax credit, but not for the earned income credit) of the noncustodial parent if all four of the following statements are true:

1. The parents:

a. are divorced or legally separated under a decree of divorce or separate maintenance,

b. are separated under a written separation agreement, or

c. lived apart at all times during the last 6 months of the year, whether or not they are or were married.

2. The child received over half of his or her support for the year from the parents.

3. The child is in the custody of one or both parents for more than half of the year.

4. The noncustodial parent attaches a Form 8332, or similar statement containing the same information required by the form, to his or her return. The form must be signed by the custodial parent. (See special rules in Publication 17 for a pre-1985 or post-1984 and pre-2009 divorce decree or separation agreement.) See Publication 17 for additional rules for claiming an exemption for a dependent.

While Trump's intentions going forward haven't been directly stated by the president, the 2024 Republican platform (archived here) from the Republican National Committee suggests the tax language will stay the same during Trump's second term in the White House. Page 13 of the platform says:

Republicans will make permanent the provisions of the Trump Tax Cuts and Jobs Act that doubled the standard deduction, expanded the Child Tax Credit, and spurred Economic Growth for all Americans. We will eliminate Taxes on Tips for millions of Restaurant and Hospitality Workers, and pursue additional Tax Cuts.

Read more

At the time this was written, Snopes had reviewed the same claim.

Other Lead Stories fact checks of claims related to Trump can be found here.