Did the prices of lumber, gas, wheat, coal and corn suddenly increase in 2021-- ever since President Joe Biden took office? No, that's not true: The global COVID-19 pandemic has had a tremendous effect on national and international economies. This, coupled with other issues unique to each item, has produced many unprecedented swings in prices.

The five commodities featured in this meme all experienced steep drops in prices in the early months of 2020 and then a turnaround, with prices climbing in the second half of 2020 and into 2021.

The meme appeared in a Facebook post (archived here) on May 23, 2021, captioned, "True story." The text of the meme reads:

HOW MUCH MORE DOES IT COST TO LIVE IN JOE BIDEN'S AMERICA?

2021 -- WHAT YEAR IS IT? -- 2020$1,500 -- 1,000 FEET OF LUMBER BOARD -- $304

$3.05 -- ONE GALLON OF GAS -- $1.95

$251 -- ONE TON OF WHEAT -- $183

$80 -- ONE TON OF COAL -- $39

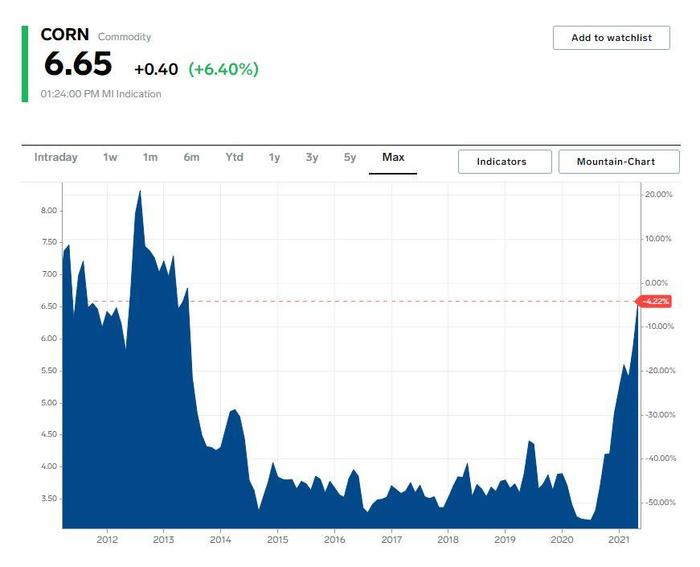

$6.86 -- ONE BUSHEL OF CORN -- $3.43(Data: Markets Insider April 2020 vs. 2021)

This is what the post looked like on Facebook on May 27, 2021:

(Source: Facebook screenshot taken on Thu May 27 17:09:13 2021 UTC)

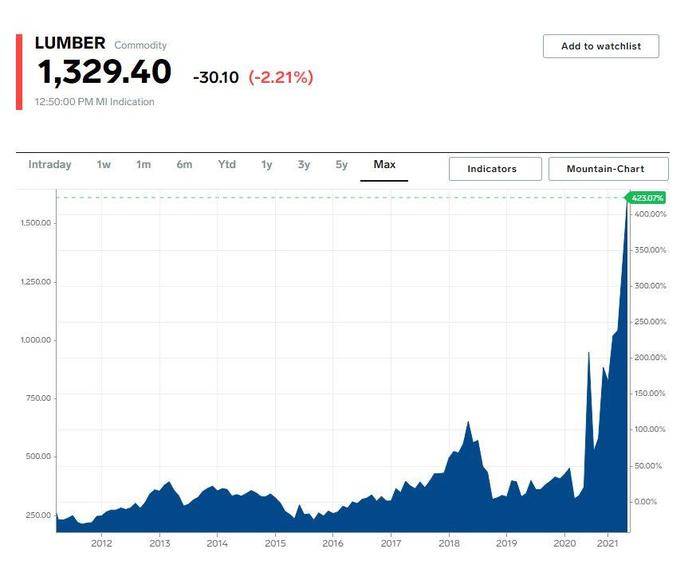

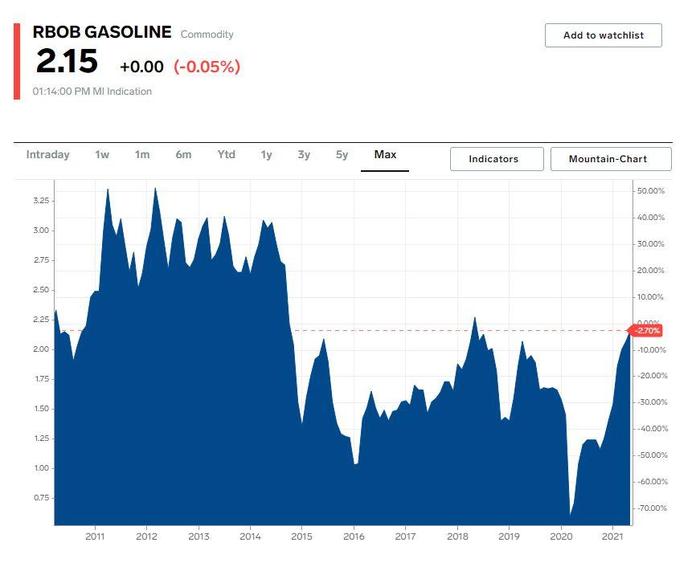

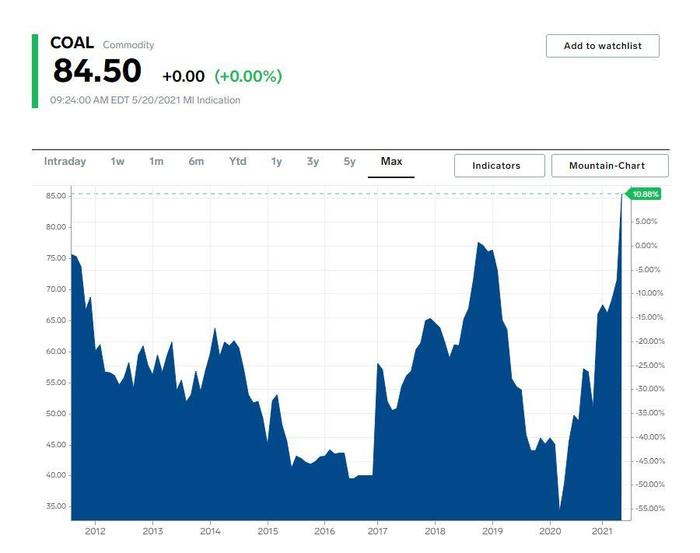

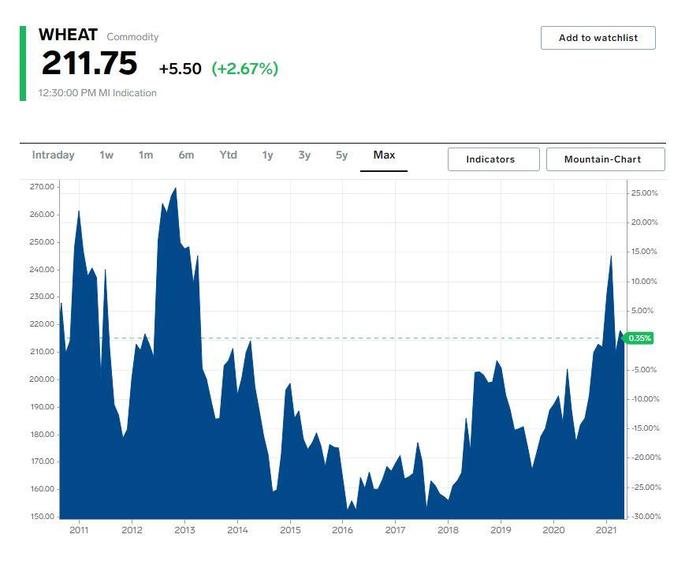

The meme cites Markets Insider as the source of the numbers. Lead Stories has pulled up a graph for each commodity from Market Insider's businessinsider.com website. Each chart has been zoomed out to show price fluctuations over the past decade. Each of the five commodities featured in the meme shows a sharp drop in the early months of 2020.

Lumber shows the most dramatic price increase. There are many factors that have gone into its sharp rise but it's a combination of high demand and short supply. The National Association of Homebuilders contacted then-President Donald Trump in a letter dated August 7, 2020. It begins:

On behalf of the National Association of Home Builders of the United States (NAHB), I am writing to alert you to the magnitude of the lumber price increases NAHB has seen in recent months and how this disturbing development could hurt the housing sector and the economy.

A similar letter was sent to President Biden dated January 29, 2021. In both letters the NAHB cites the same reasons for the shortages and high prices: lumber production that is not meeting demand, better than expected housing demand and do it yourself projects. Both letters requested that domestic lumber producers be urged to increase production and that an agreement be made with Canada regarding softwood and lumber tariffs.

In 2018 the Commerce Department imposed a 20% tariff on Canadian lumber, which was reduced to about 8.99% on December 1, 2020. Now the Commerce Department is considering raising those tariffs again, to 18.32%.

(Source: Markets Insider lumber screenshot taken on Thu May 27 19:25:01 2021 UTC)

The headline of a March 6, 2021, article on forbes.com asks, "Who is to blame for rising gasoline prices?" The article lists three points:

-

Rising oil prices

-

Loss of refining capacity

-

Transition to summer gasoline

AAA reports, "Memorial Day Travelers will Pay Highest Gas Prices since 2014." The association reports the national average of gas price has stabilized since the recent cyberattack on the Colonial Pipeline but that the demand produced by the number of people traveling for the holiday weekend -- 60% more than this time last year -- could contribute to higher gas prices.

(Source: Markets Insider gasoline screenshot taken on Thu May 27 19:25:01 2021 UTC)

Lead Stories spoke on the phone with Rosalyn Berry, technical lead of the coal statistics program at the U.S. Energy Information Administration, to learn more about the fluctuations in the price of coal. She explained that it all has to do with demand and that generally the pandemic was the reason for the low demand. There was no policy from either the former or current administration that played a role in the 2020 drop or the normalizing in 2021, Berry said.

(Source: Markets Insider coal screenshot taken on Thu May 27 19:25:01 2021 UTC)

Corn and wheat farmers have a very different outlook going into 2021 than in previous years. The grain market, which includes both corn and wheat, is complex as it involves exports and feed prices as well as ethanol considerations, plus the weather.

The cost of producing crops can also change depending on the price of considerations like fuel and fertilizer, so what it takes for a farmer to break even can depend on many other markets. In a February 14, 2021, article in spokesman.com titled, "Export boom leads to higher wheat prices for area farmers," Michelle Hennings, the executive director of the Washington Association of Wheat Growers, was quoted as saying:

'Wheat farmers need somewhere between $6 to $6.50 a bushel to cover the cost of planting, tilling, spraying and harvesting. For the past several years, farmers have struggled with prices below or near the break-even line. In talking with dealerships, a lot of farmers have bought used equipment because of the price of wheat. Most farms have operating loans. We've had a lot of bankruptcies through farming country.

Prices well above $7 a bushel, however, give a major boost to those farmers who paid to store their grain rather than selling it immediately at harvest last summer. 'We'd like to see it go up, but it's excellent if it's above $7 a bushel. When wheat prices keep going up, it helps make life a little better on the farm. It's a good thing for farmers' mental health, too.

(Source: Markets Insider wheat screenshot taken on Thu May 27 19:25:01 2021 UTC)

(Source: Markets Insider corn screenshot taken on Thu May 27 19:25:01 2021 UTC)