STORY UPDATED: check for updates below.

Did the Tax Cuts and Jobs Act raise taxes on most people earning under $75,000? No, that's not true: The 2017 law aimed to lower taxes for individuals through measures such as reducing income tax rates and raising the standard deduction. While the vast majority in the under $75,000 income group benefited from reduced taxes, a small percentage saw their taxes increase due to changes in deductions and exemptions, tax policy experts told Lead Stories.

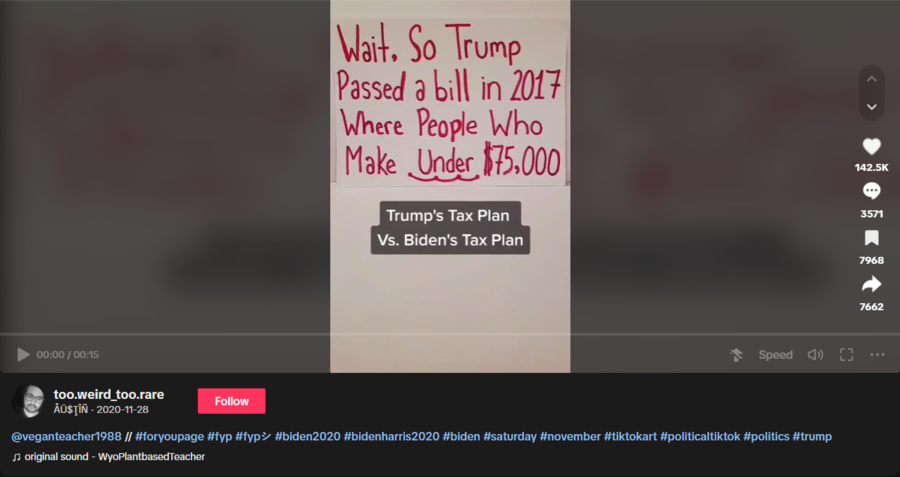

The claim appeared in a video (archived here) on TikTok by too.weird_too.rare on November 28, 2020, under the on-screen title "Trump's Tax Plan Vs. Biden's Tax Plan." The post's caption said:

@veganteacher1988 // #foryoupage #fyp #fypシ #biden2020 #bidenharris2020 #biden #saturday #november #tiktokart #politicaltiktok #politics #trump

This is what the post looked like on TikTok at the time of writing:

(Source: TikTok screenshot taken on Thu Mar 14 14:50:25 2024 UTC)

The video

During the 15-second clip, the narrator laid out their claim, which said:

Wait, so Trump passed a bill in 2017 where people who make under $75,000 will have their taxes raised in 2021 and every two years after that until 2027. While the rich get richer ... and y'all crying about Biden raising taxes for people who make over $400,000?

Tax Foundation

In emails dated March 15, 2024, Garrett Watson, a senior policy analyst at the Tax Foundation, a tax policy think tank, told Lead Stories that "most households received a tax cut from the 2017 tax law known as the Tax Cuts and Jobs Act." He continued:

If we compare the amount of taxes most households would have paid in 2018 through 2025 (including tax credits that lower taxes like the child tax credit) to taxes actually paid, most households would have paid higher taxes if the 2017 tax law had not passed. ...

According to the Joint Committee on Taxation (JCT), Congress's official scorekeeper, in calendar year 2023, about 14.3% of those earning between $50,000 and $75,000 saw a tax hike greater than $100. About 70% saw a tax cut of $100 or greater.

For those earning between $20,000 and $30,000, about 9.7% saw a tax hike of $100 or greater and 39.7% saw a tax cut of $100 or greater (The rest seeing a tax change of less than $100 in either direction).

A June 28, 2018, analysis of the TCJA (archived here) by the Tax Foundation included these conclusions in its "key findings" section:

- Lower tax liabilities and higher output will boost taxpayer after-tax income, but the impact will differ over time due to many provisions phasing in or expiring over the next decade. ...

- On a conventional basis, the TCJA would result in an increase in after-tax income for taxpayers in all income groups from 2018 to 2025.

Tax Policy Center

Howard Gleckman, a senior fellow in the Urban-Brookings Tax Policy Center at the Urban Institute, another tax policy think tank, told Lead Stories in a March 15, 2024, phone interview that there's a "kernel of truth" in the social media post's claim about the TCJA, but a "very small" one. While the Tax Policy Center's numbers differ a bit from the Tax Foundation, they tell a similar story.

The analysis by the Tax Policy Center broke taxpayers into these income groups:

- $25,000 a year or less (very low income)

- $25,000 to $50,000 (low income)

- $50,000 to $85,000/$90,000 (middle income)

Gleckman said the 2017 tax law benefited nearly everyone earning $75,000 or less (emphasis ours):

So in that lowest income group, about 1 percent of taxpayers paid a little more than they would have if the law [TCJA] didn't pass. In a second income group, about 5 percent paid a little more, and in the middle-income group, about 7 percent paid a little more. So, average all that out and you're talking about 3, 4 percent of people in those very low-, low-, and moderate-income groups, paid more in taxes. And those are people with very unusual tax situations. For the most part, say 95 percent of people in those groups, either paid the same or paid less.

Read more

Additional Lead Stories fact checks of claims about income taxes can be found here.

Updates:

-

2024-03-15T17:27:46Z 2024-03-15T17:27:46Z Updated to clarify that a small subset of those earning under $75,000 saw their taxes rise.