Are all mortgage contracts dischargeable by filing letters and forms to the IRS and the U.S. Treasury, as a social media post claims? No, that's not true: An IRS spokesman told Lead Stories that "there is no U.S. IRS form that negates a legitimate contract." Mortgage lending is subject to laws and regulations. Mortgages are contracts enforceable in court.

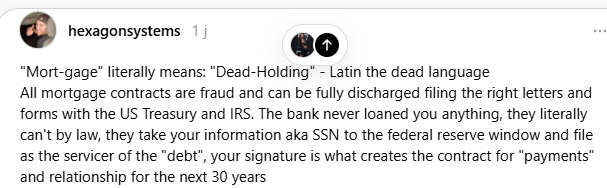

The claim appeared in a post (archived here) published on Threads on December 28, 2024. It opened:

Mort-gage" literally means: "Dead-Holding" - Latin the dead language All mortgage contracts are fraud and can be fully discharged filing the right letters and forms with the US Treasury and IRS. The bank never loaned you anything, they literally can't by law, they take your information aka SSN to the federal reserve window and file as the servicer of the "debt", your signature is what creates the contract for "payments" and relationship for the next 30 years

This is what the post looked like on Threads at the time of writing:

(Source: Threads screenshot taken on Mon Dec 30 18:38:45 2024 UTC)

An IRS spokesman told Lead Stories in a phone call on December 31, 2024, that "there is no U.S. IRS form that negates a legitimate contract."

"All mortgage contracts" are not "fraud." Mortgage lending is subjected to laws and regulations. A list of reference materials on the matter is available on the U.S. government's Federal Deposit Insurance Corporation website.

A spokesperson for the Consumer Financial Protection Bureau told Lead Stories in an email on December 31, 2024 that it was "unaware of any basis for blanket invalidation of mortgage contracts, which, like other contracts, are primarily governed by state law."

Lead Stories reached out to the U.S. Treasury, the Federal Deposit Insurance Corporation and mortgage legal experts. An update will be provided if a response is received.