Would the Internal Revenue Service receive over 66 percent of a $1.28 billion lottery prize if someone wins it? No, that's not true: The claim significantly overestimated federal tax payments because it did not consider that the lump sum payment is almost always less than the advertised value since it's determined by how much cash the entity selling lottery tickets has on hand.

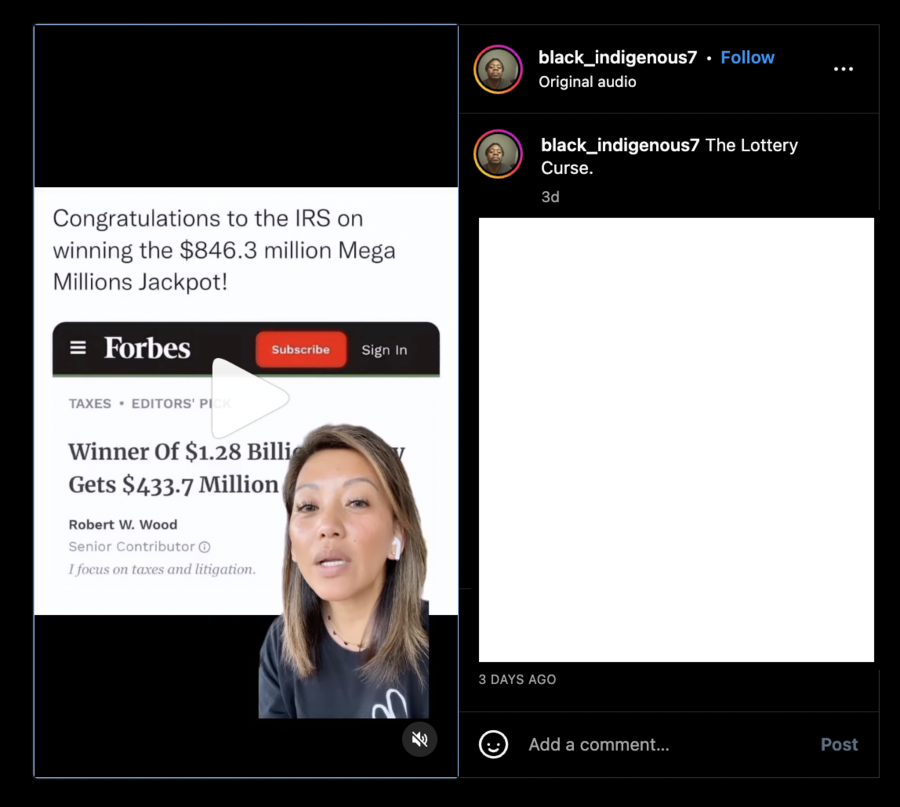

The story resurfaced in a post on Instagram on June 17, 2023. It contained a screenshot of an article titled:

Winner Of $1.28 Billion Lottery Gets $433.7 Million After Tax

A top banner placed above the headline continued:

Congratulations to the IRS on winning the $846.3 million Mega Millions Jackpot!

This is what it looked like at the time of writing:

(Source: Instagram screenshot taken on Tue Jun 20 14:49:15 2023 UTC)

The post showed a screenshot of a Forbes article published on July 30, 2022. Contrary to the claim, it did not state that the Internal Revenue Service will collect "$846.3 million Mega Millions." Before getting into the taxation of lottery income, the first paragraph of the article explained the rules of receiving the money:

The $1.28 billion prize, which is the second-largest jackpot in Mega Millions lottery history, can be claimed in a lump sum or over time. The 1.28 billion is only if you take it over time, but if you want it all now, you get $747.2 million.

The piece specifically said that it addressed the most common situation because people generally prefer "the lump sum, not the annuity."

According to the IRS website, some categories of income are subject to a mandatory federal withholding currently set at 24 percent. Gambling winnings are one of those categories, as the Forbes article said:

The winning cash prize of $747,200,000 after the 24% IRS withholding tax, drops to $567,872,000

Yet, because the remaining amount exceeds $539,900, which was set as a minimum amount for the application of the maximum tax rate of 37 percent in the 2022 tax year, an additional federal payment is required. If a lottery winner is married and the couple files their return jointly, that person would stay in the previous tax bracket, where the tax rate was 35 percent in 2022.

According to the Forbes estimation, the second federal payment would take away another $97 million. Thus, the total a lottery winner would be required to pay to the IRS reaches roughly $276 million, not $846 million, as the post on Instagram claimed.

After that, a person would also need to pay state or city taxes if their locality collects them. That varies significantly across the United States, which the Forbes piece did not discuss.

Similar claims circulated on social media in January 2023, around the time the estimated Mega Million jackpot reached $1.1 billion.

According to an AP calculation, the winner of such an amount would have to pay about $210 million in federal taxes, if they choose the lump sum.

The difference between the AP and Forbes estimations is easily explained by fluctuating variables.

The website of Mega Millions, which describes itself as "a consortium of lotteries" without a "central office," explains that the size of the lump sum may be different every time, depending on how much cash a paying entity has readily available at the time of winning:

Those sales estimates are then used to determine the estimated cash value of the jackpots and the advertised annuity values, with the annuity value based on that day's 30-year U.S. Treasuries rate, which can change day to day.

Other Lead Stories fact checks about lotteries can be found here.